The BrainChip Holdings Ltd (ASX: BRN) share price rose by 25% on Thursday. This was essentially due to the company achieving a milestone in the development of its Akida Neuromorphic System-on-Chip. Now, if you're a non-tech type, this probably means very little to you. Suffice to say that the company is an artificial intelligence (AI) startup which, in the words of its CEO, Louis DiNardo, just reached an "…exciting and pivotal moment in BrainChip's evolution to commercialize a very powerful technology that addresses the burgeoning AI Edge market…"

If, on the other hand, you are technically inclined, feel free to read on for more details on this development.

What does the company do?

BrainChip is a United States based company listed on the ASX that is focused on neuromorphic technologies. Neuromorphic systems are large-scale systems of integrated circuits. Therefore, as the name implies, they mimic the human nervous system. In addition, Neuromorphic Computing is considered the 5th generation of artificial intelligence by the Artificial Intelligence Board of America. Having listed on the ASX in 2011, BrainChip has three main products:

First, The Akida Development Environment (ADE). ADE is a complete, industry-standard, machine learning framework for creating and training neural networks to run on the company's Akida Neural Processor. Still with me?

Second, the Akida Neural Processor is an ultra-low power network processor. This is actually the brain that powers the continuous learning that AI is based on. Furthermore, the increased responsiveness and greater power efficiency of the system can help reduce the carbon footprint of data centers by reducing the need for cooling.

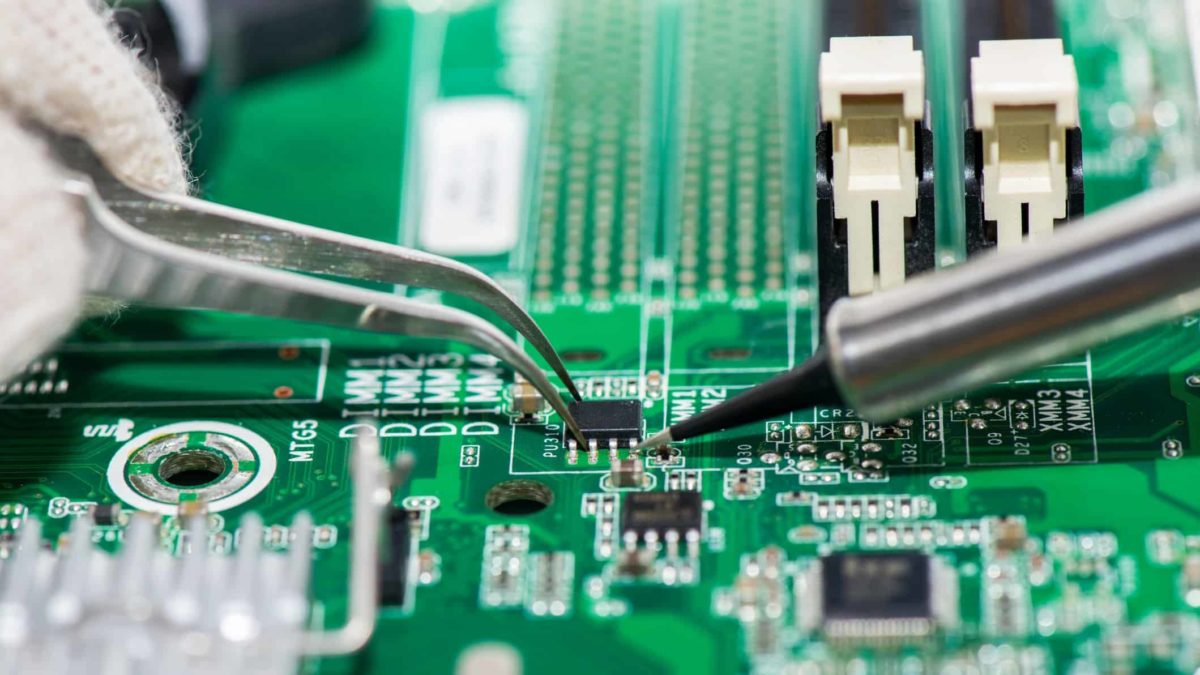

Third was the subject of today's announcement. The Akida Neural Processor System-on-Chip (NSoC), a revolutionary new breed of neural processing computing device. Each of these effectively has 1.2 million neurons and 10 billion synapses which results in significantly greater efficiency than other neural processing devices on the market.

What caused the BrainChip share price to climb?

BrainChip and the company's partners have completed the fabrication of the NSoC integrated circuit (IC) wafer. Next, the company will be completing the assembly and test operations. After that, the prototype chip will enter the initial evaluation program, and then be shipped to customers that have signed agreements for the early access program.

BrainChip has previously announced the signing of an agreement with Valeo Corporation, a Tier-1 European automotive supplier of sensors and systems for Advanced Driver Assistance Systems (ADAS) and Autonomous Vehicles (AV). This agreement ensures BrainChip will receive milestone payments during the development stage of the NSoC IC.

The BrainChip share price rallied 25% on Thursday to close at 11 cents, bringing its market capitalisation to just over $162 million. In addition, the company's share price is up by 120% over the calendar year to date. Whether this momentum continues will likely depend on the progress of BrainChip's assembly and testing phases of the product's development. Watch this space…