The CSL Limited (ASX: CSL) share price has almost returned to its pre-bear market highs in trading today.

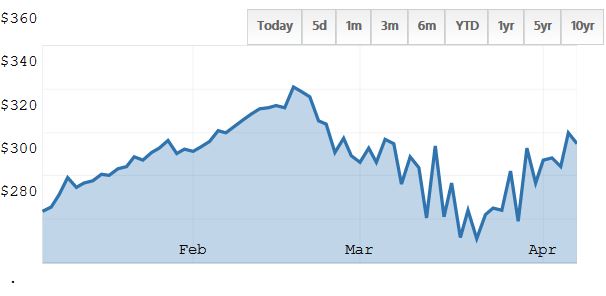

The CSL share price is going for $314.95 at the time of writing this afternoon. CSL's last all-time high was hit on 19 February, when the stock reached $342.75 a share. That means CSL is only around 9% off this pre-crash high today and at the same level it was on 4 February a fortnight before that.

It's almost like this ASX bear market never happened for this healthcare giant – as you can see from the graph below!

Of course, CSL was initially sold-off along with the rest of the S&P/ASX 200 Index (ASX: XJO) when the bear market was really sinking its claws into the ASX. The company's shares were briefly under $270 on 20 March, meaning anyone who bought in then would be sitting on a 16% gain today – not too bad at all.

Why has the CSL share price recovered so strongly?

Well, in part it has to do with the recovery of the broader ASX as well. The ASX 200 has also recovered significantly since 20 March, also notching up gains of around 16%.

But CSL only fell 21% peak-to-trough last month, whereas the ASX was down around 35% over the same period.

This outperformance (both on the downswing and the upswing) can be put down to 2 things, in my opinion.

Firstly, CSL's enduring quality. This is a company that has grown at a healthy rate over the past 2 decades-plus, and has managed to keep growing throughout the GFC, dot-com bubble, and every other kitchen sink that has been thrown at it. Its R&D department remains world-class, and will no doubt continue to fuel this company's dominance well into the future.

Secondly, CSL is not in an industry that will be adversely affected by the coronavirus and related economic shutdowns. As an 'essential' healthcare company, CSL is not likely to see the kind of significant drop in earnings that other ASX companies will, unfortunately, have to deal with in this difficult time.

In fact, CSL is helping in the search for solutions to this current pandemic, which it can hopefully assist with in the coming months.

Foolish takeaway

CSL remains a high-quality company that investors are still willing to pay a premium for, even in these uncertain times. For myself, the share price is a little too high to consider an investment in today, but this company is one that will remain on my wish list regardless.