WAM Global Ltd (ASX: WGB) is a diversified global portfolio managed by Wilson Asset Management that focuses on small to mid-cap international companies and aims to outperform the MSCI World Index.

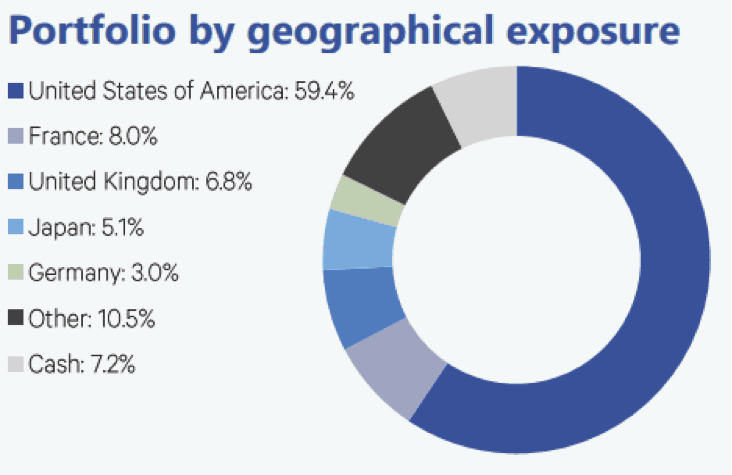

The top 20 holdings in the portfolio include companies such as AIRBUS (NYSE: BA) and Logitech International with the portfolio being mostly invested in the United States (US), but with holdings around the world, as shown below.

Source: WAM Global October Investment Update

With the WAM Global share price recently rising back up to around the IPO level of $2.20, I think WGB is starting to find some traction after seeing a low of just $1.85 last December. Although the fund has underperformed its benchmark since inception, this gap has been closing and in my opinion investors should take a long-term view to allow the fund's investment strategy to play out. This is the same strategy that has seen a return of 16.8% pa for WAM Capital Ltd (ASX: WAM) since its inception in 1999. Now I'm not saying we can expect the same returns, but it shows that investors need to be patient.

WAM Global has achieved a portfolio performance of 23.3% since the beginning of the year and has grown its profit reserves to 15.7 cents per share. From these reserves it paid its inaugural fully franked dividend of 2 cents on October 25. Although this is a grossed-up yield of only 1.3%, I believe it is only the beginning and investors can expect to see a steadily rising yield.

Another positive sign is the recent buying by insiders including Chairman and CIO Geoff Wilson. Mr Wilson has been consistently adding to his already significant holdings throughout the year and has been topping up again recently. I believe this is because the WAM Global share price currently trades at a discount to its net tangible assets (NTA) value.

In fact, according to its most recent investment update, WAM Global it is trading at a discount of 8.6% to its NTA. This is in contrast with most of the other portfolios managed by Wilson Asset Management, including WAM Capital, which currently trades at a premium of 12.9%. This current discount to NTA is something that Wilson Asset Management are looking to decrease.

Foolish takeaway

I believe over time as the investment strategy plays out this gap will close, and the WAM Global share price may even trade at a premium like most of the other Wilson Asset Management portfolios.

Because of this, the global diversification the fund offers through its global exposure, and the success of the company's other portfolios, I would be happy to follow Geoff Wilson and buy WGB shares today or even top up my holdings.