Often it's worth taking investment advice straight from the horse's mouth to borrow a metaphor.

This is because investors should rely on primary information to draw investment conclusions or to calculate valuations.

Primary information generally includes companies' accounts, annual reports, earnings reports or other miscellaneous presentations.

The numbers in these documents should all be audited and correct to mean the information is incorruptible if applied properly.

However, often investors will use third-party information sources such as stock market news websites, online share forums, or others financial wires to derive incorrect information over a company's market cap or dividend yield for example.

The one problem with only relying on a company's presentations or accounts is that they tend to highlight positives and obscure the negatives. After all the higher a company's share price the cheaper it can raise capital.

So you can hardly blame the companies for wanting to present themselves in the best possible light, it's just that professional investors know to always dig deeper in conducting their research.

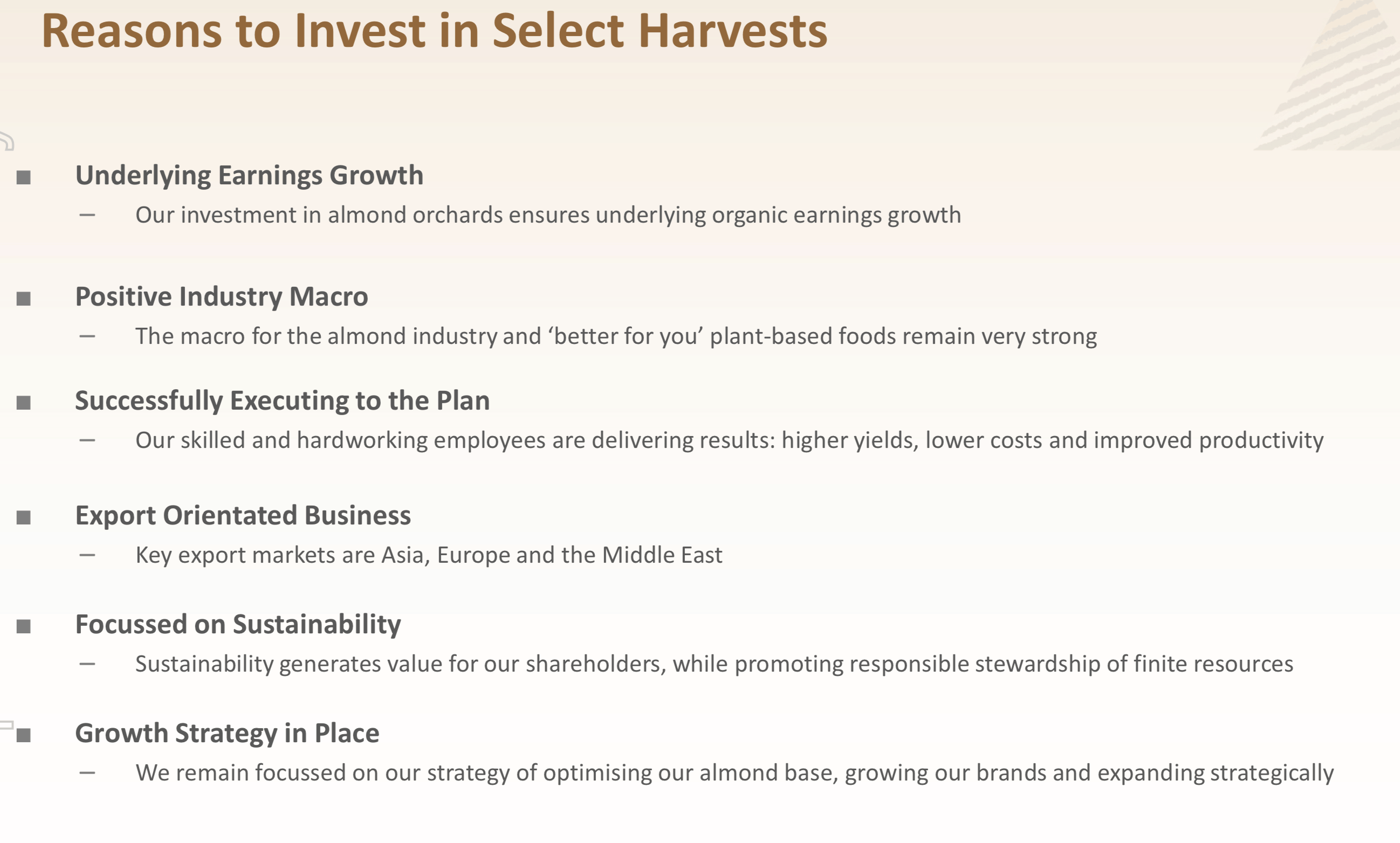

This morning almond producer Select Harvests gave investors six reasons it thinks its shares are a good buy for investors.

Source: Select Harvests, presentation Dec 10, 2019.

You can't argue with those reasons as the almond farmer is exposed to rising demand from the Asian middle class and the trend towards healthy eating.

For the 12 months ended September 30 2019 it paid dividends of 20 cents per share on earnings of 55.5 cents per share.

On a trailing basis shares offer a 2.4% yield on 15.3x earnings. Annualised return on capital employed stands at a decent 16.5%. Net debt to equity is just 6.6% with no bank debt and a $27.4 million 'finance lease'.

The group is in reasonable financial shape and shares are potentially cheap if it can consistently grow earnings.

However, risks include the fact it's reliant on almond prices that can rise and fall, agricultural conditions, and underlying demand.