The Telstra Corporation Ltd (ASX: TLS) share price is higher on Wednesday following the release of its investor day presentation.

At the time of writing the telco giant's shares are up 0.3% to $3.62.

What was in the presentation?

Telstra released a comprehensive presentation which included a reminder of its T22 goals and its expectations for FY 2020.

One area covered by management was its costs. Telstra continues to expect total operating expenses to decline this year. It is targeting a $630 million reduction in its fixed costs, which is expected to offset increased nbn network payments and other variable costs.

This will put it on course to reduce underlying fixed costs by a cumulative $2.5 billion by FY 2022. As of the end of FY 2019, it had achieved a $1.17 billion reduction.

Telstra also provided an update on its Mobile segment. Pleasingly, it notes that the mobile market is continuing to return to more rational competition.

It also revealed that it has seen a sustained rise in its leading ARPU indicator – Transacting Minimum Monthly Commitment (TMMC), since the release of new plans in June. While this won't stop its postpaid ARPU from declining in the first half, it is confident that it will return to growth within the next 12 months.

FY 2020 guidance.

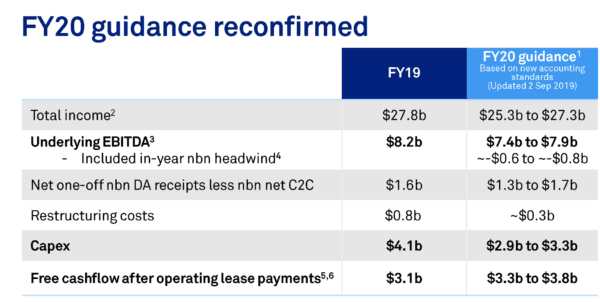

Telstra has reconfirmed its guidance for FY 2020. It continues to expect its underlying EBITDA to grow by up to $500 million this year. This excludes the expected in-year headwind of the nbn and is entirely down to the $630 million reduction in its fixed costs.

The remainder of its guidance can be seen on the table below:

It is worth noting that management expects the second half to be the stronger half. The majority of its underlying EBITDA growth is expected during that period due largely to the expected improvement in its mobile business.

Given its free cash flow expectations, Telstra looks well-positioned to maintain its 16 cents per share dividend in FY 2020. This equates to a forward fully franked yield of ~4.5%.