The iSignthis Ltd (ASX: ISX) share price may still be suspended, but that hasn't stopped the payments company from releasing its October update.

How did iSignthis perform in October?

According to the release, at the end of October the company's unaudited actual annualised gross processing turnover volume (GPTV) exceeded $2.25 billion. This is up 13.5% on the $1.9 billion reported at the end of September and 423% since the end of June.

The release explains that actual processed transactional volumes within the EU and Australian Paydentity ecosystem continue to grow in line with expectations.

This company also advised that its Merchant Services Fee (MSF) percentage is consistent with the targeted 125bps ecosystem average.

In addition to this, the Paydentity ecosystem continues to expand as a business service offering. This is due to its focus on growth through customer acquisition and multiple revenue lines, including card acquiring and eMoney accounts growth.

What's next?

iSignthis is continuing to work through a growing pipeline of business customer applications.

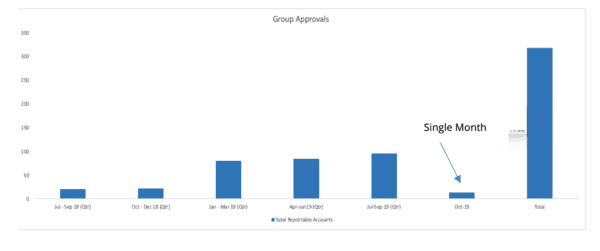

Management advised that its approvals continue to grow consistently "in line with expectations". Though, it is worth noting that October's approvals have suddenly dropped off in comparison to previous periods.

As you can see on the table below, even for a single month, October looks decidedly weak. This comes at a time when iSignthis is facing a lot of questions over some of its customer-base.

In response to recent criticism, the company stressed that it services business customers who hold appropriate licensing for services they offer within their target jurisdictions. This includes Australian Securities and Investment Commission authorised Australian Financial Services License holders.

Will iSignthis shares return soon?

Earlier this month ASX revealed that its enquiries into iSignthis are ongoing. And given the circumstances, it considers it appropriate that trading in its securities remains suspended until further notice.

No timeframe has been given by the ASX, but given the complexities of its business and the large number of queries being made, I suspect its shares will be offline for some time to come.

But if they did come back in the near future, I would suggest investors stay clear of them and focus on other payments options such as Afterpay Touch Group Ltd (ASX: APT) and Pushpay Holdings Ltd (ASX: PPH) instead.