Woodside Petroleum Limited (ASX: WPL) shares edged marginally lower this morning despite the WA oil and gas giant revealing plans to triple its proven or probable reserves.

Woodside's two core assets for now are its Pluto and North West Shelf LNG projects on offshore WA. These are known as its cash cows as they're amongst the highest volume, lowest cost, and strongest margin producers in Australia.

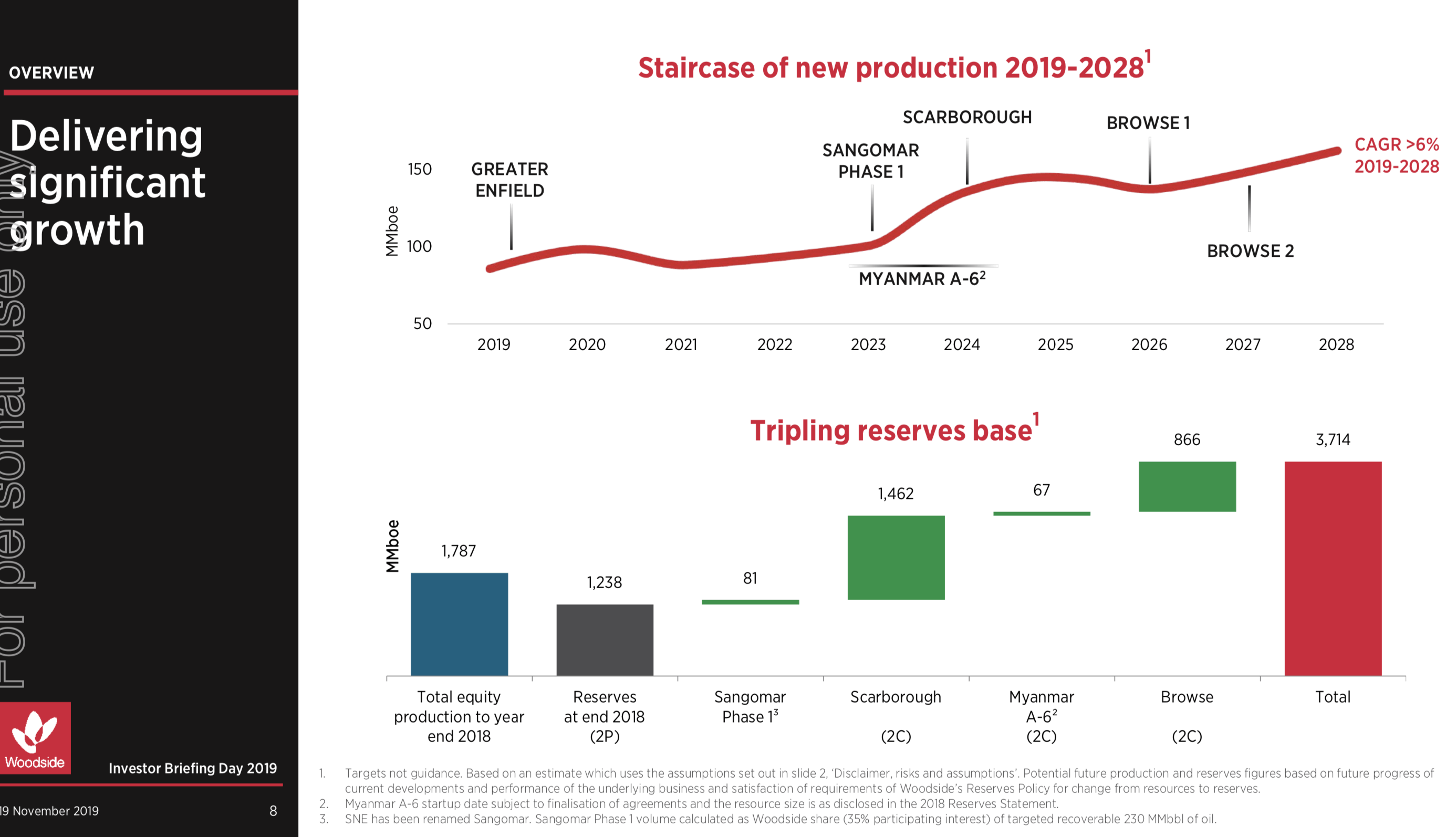

At its AGM today the group flagged how it plans to invest heavily to triple existing reserves with the chart below plotting how it intends to reach that goal by 2028.

Source: Woodside investor presentation, Nov 19, 2019.

In FY 2018 Woodside produced free cash flow of $1,524 million on operating revenue of $5,240 million. Its long term policy is to pay out 50% of underlying net profit as dividends, although last year that stretched to 80%.

Other popular businesses in the LNG space include Santos Ltd (ASX: STO) and Oil Search Limited (ASX: OSH).