Sonic Healthcare Limited (ASX: SHL) shares opened marginally higher this morning after management stuck to guidance for underlying earnings before interest, tax, depreciation and amortisation (EBITDA) growth between 6% to 8% over FY 2020.

FY 2019's net profit grew 15% at $550 million, on underlying EBITDA of $1,052 million on sales up 11.6% to $6.2 billion.

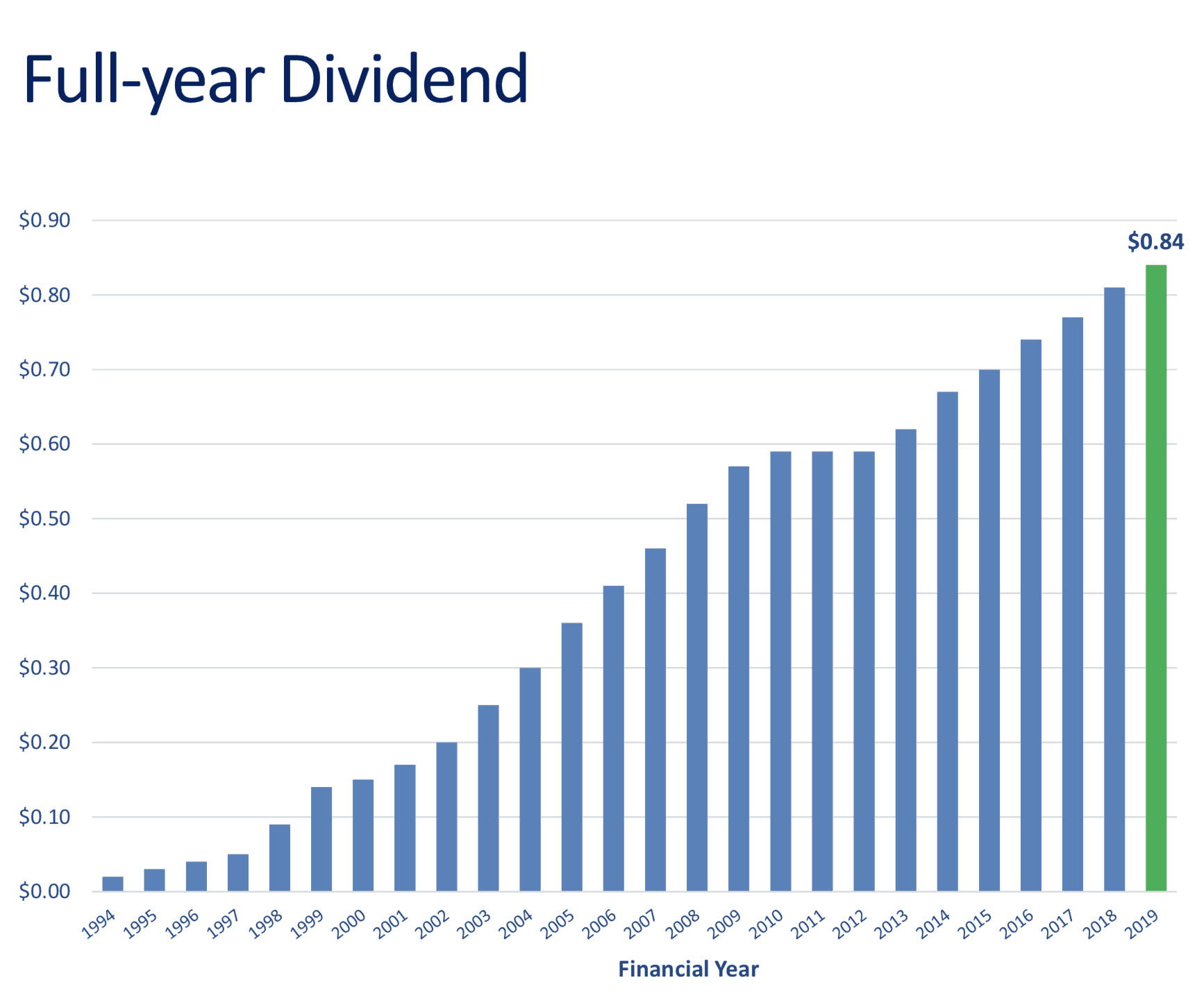

Sonic boasts a formidable track record of organic and acquisitive growth that has translated into a second-to-none track record of long-term dividend growth amongst companies on the benchmark S&P/ ASX200 (ASX: XJO) index.

Since FY 2012, Sonic's dividends have climbed from 59 cents per share to 84 cents per share. The long-term track record of dividend growth actually goes back to 1994.

The chart below says more than a 1,000 words and is a dividend investor's dream.

Source: Sonic Healthcare presentation, November 19, 2019.

Source: Sonic Healthcare presentation, November 19, 2019.

At the end of the day, investing is not rocket science.

Earnings pay dividends at quality companies that are not over-leveraging their balance sheets.

And share prices will follow earnings or dividends higher or lower over the long term.

Sonic shares are up more than 10x since 1999, and you cannot beat the combination of rising dividends and share prices as an investor.

Anecdotally, I've also met a couple of Sonic's Sydney employees. It has a long-serving management team and strong culture where employees at all levels tend to stay for the long term. Generally, good companies don't lose good people.

Sonic's culture is another major positive in my book.

As such I'd stick Sonic on my research list alongside the likes of CSL Limited (ASX: CSL) and Cochlear Ltd (ASX: COH).