The Afterpay Touch Group Ltd (ASX: APT) share price has been volatile following the release of a business update ahead of annual general meeting.

In morning trade the payments company's shares surged as much as 10% higher before giving back all their gains and sinking lower.

What was in Afterpay's business update?

Afterpay's business update revealed further strong growth across all geographies and channels during the first four months of FY 2020.

At the end of October, the company's global underlying sales reached $2.7 billion. This was a massive 110% increase on the prior corresponding period. This comprises ANZ underlying sales of $1.9 billion, US underlying sales of $0.7 billion, and UK underlying sales of over $100 million.

Furthermore, at the end of the period its underlying sales had increased to over $8.5 billion on an annualised basis. And that's before the all-important holiday period.

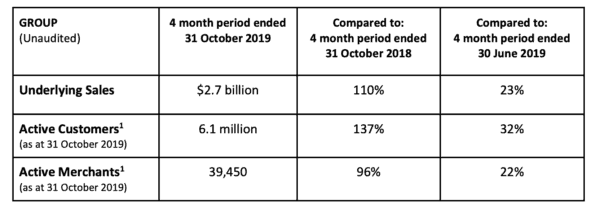

On the table below you can see a summary of its performance over the four months.

As you can see above, Afterpay's active customers grew 137% on the prior corresponding period to 6.1 million.

This follows a particularly strong performance during October where Afterpay onboarded an average of 15,000 new customers per day. This represents its largest customer acquisition month on record.

Management also provided an update on other key metrics. It advised that purchasing frequency, loss rates, and customer lifetime value are all improving the longer that customers are on its platform.

In Australia and New Zealand, customers who joined Afterpay during FY 2015 and FY 2017 are now purchasing, on average, approximately 22 times per year.

Newer cohorts are following a similar upward trend, with the FY 2018 and FY 2019 cohorts purchasing, on average, 14 times and 7 times per year, respectively.

eBay Australia deal.

Almost 40,000 merchants are now active on the Afterpay platform, almost double the prior corresponding period. This reflects the onboarding of both higher margin SMB merchants and key new enterprise merchants.

A number of major brands have either recently integrated or are in the process of onboarding. This includes ecommerce giant eBay (Australia), Ulta, Finish Line, and Marks & Spencer. Afterpay is also launching with David Jones and Myer Holdings Ltd (ASX: MYR) in-store.

Collectively, management estimates that these merchants represent addressable underlying sales well in excess of $10 billion.

The deal with eBay Australia is expected to go live in the 2020 calendar year. This is a major win for the company given that eBay Australia is the largest shopping site in the country with 11-million unique monthly visitors.

Private placement.

The release also revealed a A$200 million private placement and proposed strategic partnership with leading US based technology investor, Coatue Management.

The proceeds will be raised at $28.50 per share, representing a 2.4% discount to the last closing share price and a 3.8% premium to the 5 day VWAP. These funds will be used for global platform expansion opportunities beyond mid-term plan deliverables.