Xero Limited (ASX: XRO) shares hit a record high of $73.90 today after the online accounting specialist posted a net profit of NZ$1.3 million on revenue of NZ$338.7 million for the six months ending September 30 2019.

As expected Xero also revealed it now has more than 2 million SME subscribers as it added 239,000 subscribers over the six-month period. This compares to 193,000 subscribers added in the prior corresponding period and shows how in nominal terms subscriber growth is accelerating.

The highlight of the result is the ongoing success in the UK market that has benefited from the tailwind of the UK tax office's decision to force SMEs to deliver tax returns online.

More generally governments and tax offices globally are going to ramp up efforts to force more small businesses to report financials online.

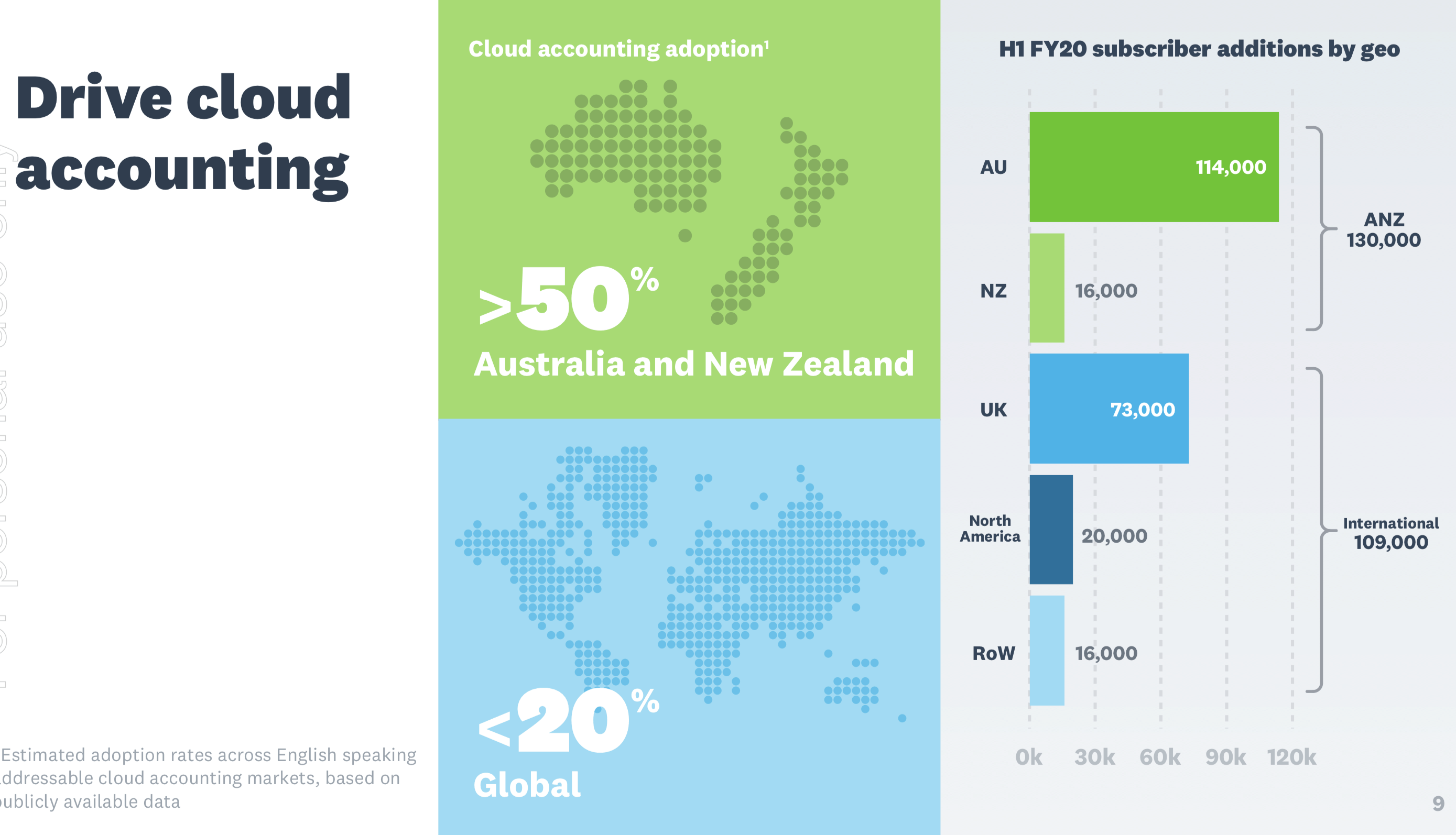

Below is a table summarising Xero's growth by geographic region over H1 FY 2020.

Source: Xero presentation Nov 7, 2019.

A couple of points to note on the graphic above are that Xero is still relatively small in cloud accounting outside its core ANZ market.

This means it has a lot of room for growth assuming it stays in a strong competitive position.

Secondly we can see that cloud accounting adoption rates are still less than 20% ex-ANZ. In other words 80% of SMEs still use Excel spreadsheets or other offline methods to complete their accounts and file tax returns.

Again this shows Xero has a lot of room to grow.

Scalability as the Holy Grail

Another key, but often overlooked quality of the popular cloud-based software-as-a-service (SaaS) growth stocks is scalability.

For example Xero can hoover up subscribers across its one platform and then keep them locked into its eco-system.

Moreover, once a client subscribes Xero can provide platform updates for better functionality, new plug-ins, features, etc, to all of its 2 million plus subscribers over the internet.

Much in the same way your iPhone software updates can be completed over the internet.

This means the SaaS model is very scalable compared to a business like Uber where one driver can only drive one car at a time. Or Menulog where one delivery rider can only deliver one meal at a time.

The likes of Menulog and Uber will struggle to deliver profits, but the scalability of a business like Xero is an attractive quality for investors.

This is because all the outrageous growth companies of recent times like Facebook, Shopify, Salesforce, Google and Netflix have harnessed the scalability of internet platforms to provide investors eye-watering returns. And that's a fact.

Other metrics improving

Elsewhere, churn came in flat at 1.1% and this is an impressively low number for a SaaS business.

Churn is a key metric to watch for many reasons including because the SaaS model is a strength and weakness.

On the one hand the recurring revenue it provides is on very high gross margins, but on the other hand the monthly payment model means a subscriber is free to quit anytime.

Previously for example a client would pay a large upfront fee for software outside the cloud and then be stuck with it whether they liked it or not.

Other key metrics such as customer acquisition cost (CAC) are also falling to suggest the business is driving efficiencies across its sales and marketing spend that has been admittedly high.

Free cash flow of $4.8 million came in at 1.4% of operating revenues with the CEO forecasting that level to remain over the second half of fiscal 2020. This is decent news given the revenue growth should remain strong.

Investors can forget any hopes of dividends being paid from the free cash flow for now though as it wouldn't make sense to pay dividends anyway.

Not when the group has such a huge opportunity to reinvest to acquire more profitable market share and build out its product platform for new revenue streams.

The balance sheet is strong with NZ$101.4 million net cash on hand.

Foolish takeaway

Among the popular WAAAAX stocks Xero and Altium Limited (ASX: ALU) have remained my preferred picks for the last few years. This is because they're both delivering strong organic growth.

Xero perhaps has the most raw upside, although Altium is already highly profitable, expanding margins, executing to targets and trades on less racy valuation multiples than its peers.