The Tinybeans Group Ltd (ASX: TNY) share price dropped 13% to $2.10 today after reporting a quarterly operating cash loss of $560,000 on revenue of $1.1 million. The main overhead was staff costs of $1.01 million. It raised $5 million over the quarter to leave it with cash on hand of $5.15 million.

What is Tinybeans?

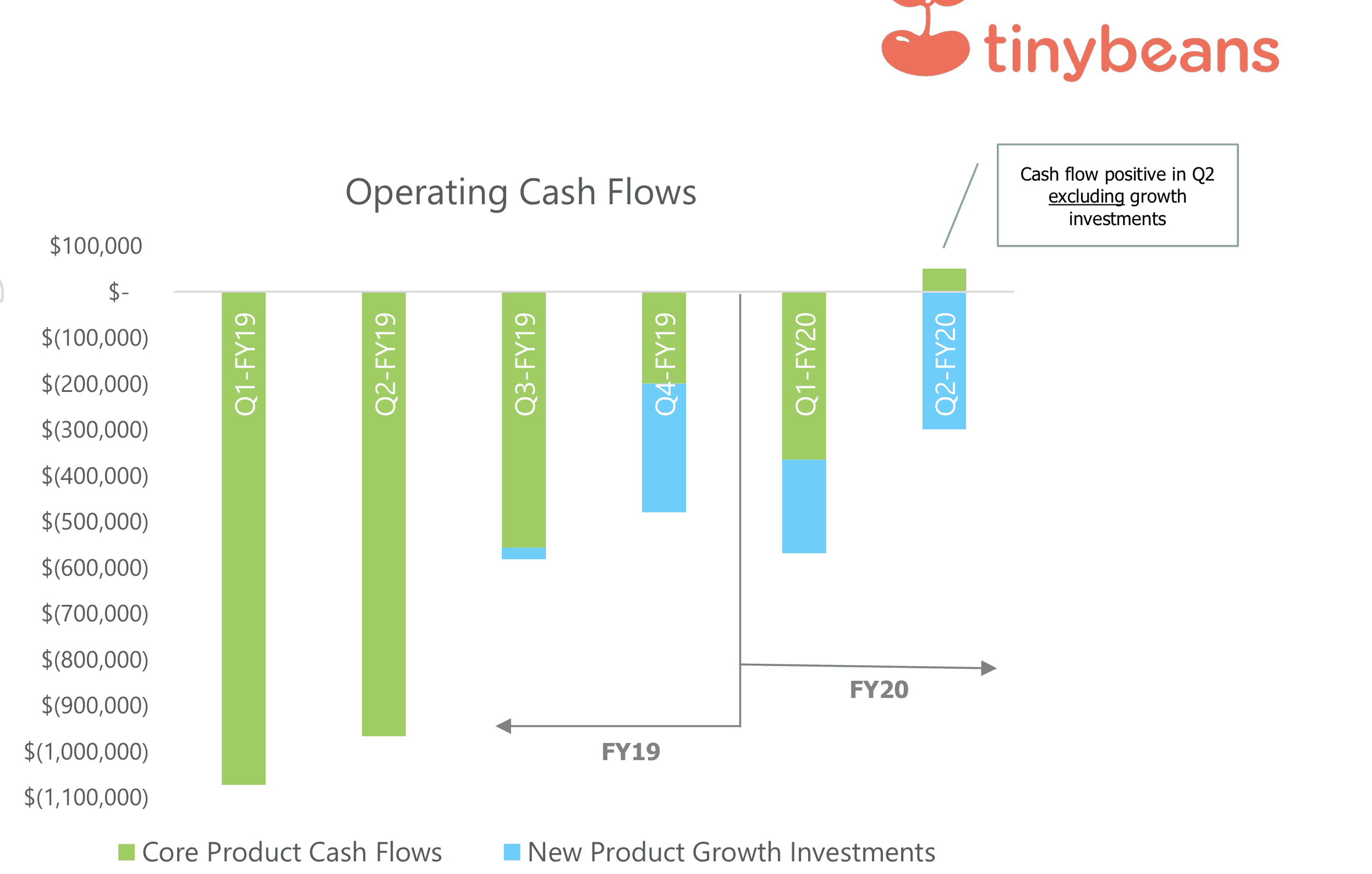

Tinybeans' tech platform is like a private Instagram for families to share photos of their children on a private basis. It grew 210,000 users over the quarter to a total of 3.55 million globally. It also expects to turn cash flow positive (ex growth investments) over the next quarter. Investors can see below that 'core product' cash flows are heading in the right direction.

Source: Tinybeans presentation, Oct 23, 2019.

Source: Tinybeans presentation, Oct 23, 2019.

It earns revenue via a mix of advertising and premium subscriptions with the only problem being it doesn't have much revenue. Not for a company valued at $80 million based on 38.04 million shares on issue.

Given the lack of a moat I wouldn't suggest buying Tinybeans shares. However, I might be proved wrong in that suggestion.

Other junior internet businesses to consider include Megaport Ltd (ASX: MP1) or Redbubble Ltd (ASX: RBL).