The HUB24 Ltd (ASX: HUB) share price will be one to watch today after releasing its first quarter update.

What happened in the first quarter?

Hot on the heels of a strong update by Netwealth Group Ltd (ASX: NWL) on Thursday, the investment platform provider has released one of its own this morning.

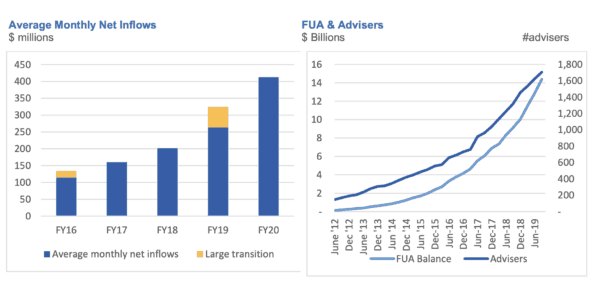

According to the release, during the first quarter of FY 2020 HUB24 achieved net inflows of $1,238 million. This was a 94% increase on the prior corresponding period. Gross inflows came in at $1,673 million for the quarter.

This left the company with Funds Under Administration of $14.4 billion at the end of September. Which is 57% higher than the same time last year. This growth can be seen on the chart below.

Management advised that this means the HUB24 platform continues to grow at the fastest rate in the industry. Furthermore, it is ranked 2nd for both quarterly and annual net inflows in the latest available Strategic Insights. Netwealth is leading the pack on these metrics.

And as with Netwealth, the key driver of its growth has been the trend of advisers moving away from institutions following the Royal Commission. At the end of the quarter HUB24 had 1,705 advisers on its platform. This was 29.3% higher than the prior corresponding period.

HUB24's managing director, Andrew Alcock, was pleased with the company's start to FY 2020.

He said "We are pleased with the great start to FY20, with Net Inflows of $1.2 billion almost double the level of the first quarter of FY19. We're continuing to grow our pipeline by securing new relationships and remain focussed on continuing to invest to further consolidate our industry leading position."

Looking ahead, management notes that it has a growing pipeline of opportunities. This could be a sign that it expects the strong growth to continue for some time to come.

The release explains: "HUB24's pipeline of opportunities is growing, and the platform offer continues to resonate with licensees and advisers across a diverse range of advice models, with 20 new agreements signed during the quarter including large boutiques licensees, brokers, self-licensed and advisers operating within an aggregator model."