The below article has been contributed by James Rodda, the sector head of TMT research at Antipodes Partners.

A pragmatic value approach seeks quality and growth in less obvious parts of the market.

Finding attractive value in one of the world's biggest companies might seem unusual for a value investor and to many Microsoft may seem expensive. However, we'd argue that the rerating is justified given the tech giant is currently experiencing one of its most rapid periods of growth in its 44-year history with a long runway ahead.

- Microsoft's extraordinary 'bundling power'

Microsoft's 'Office 365' and 'Windows 365' bundles are aimed at around 677 million office workers in countries classed as either 'high income' or 'upper-middle income' (excluding China).

Antipodes estimates around 500 million office workers will need to use a broad software suite at some point in time. Around 180 million currently pay for the Office 365 bundle and around 20 million use Google's equivalent, G-suite. It's thought a further 300-400 million use either on-premise Microsoft Office or a pirated version.

Microsoft is working to capture as much of the customer wallet with its Office 365 offerings. Office 365 has become a powerful suite that bundles Microsoft's SaaS (software-as-a-service) software into a single product – powering desktops, laptops and mobile phones.

A full-featured Office 365 bundle with security features costs US$35/month or US$20/month without security. More basic versions go down to about US$10/month.

The most comparable bundle is G-Suite from Google which is still priced at a premium – US$25/month for full suite without security and US$12 for the equivalent to Microsoft's US$10/month product. G-Suite arguably lacks many of the capabilities found in Teams, Active Directory, Analytics and other Microsoft products.

To produce an alternative bundle to match Office or G-Suite, one would be required to operate a collection of 'best-in-breed' SaaS offerings.

It would look something like this:

Slack (Teams alternative)

Smartsheet, Airtable, Quip or one of many other start-ups (Word, Excel, Powerpoint)

Dropbox (OneDrive, SharePoint)

Zoom or RingCentral (Skype for Business, Teams)

Front (Outlook, Exchange)

Symantec (Windows Defender)

Looker (Power BI) Trello(Planner)

Okta (Active Directory)

We estimate the cost of a collection of these stand-alone services is about US$80/month and we think we're being generous; Zoom alone costs $20/month, more than half the cost of the entire Office 365 bundle. It also comes with the complexity of having more vendor relationships, and software that has weaker integrations vs the simplicity of dealing with Microsoft or Google.

Zoom (a voice and video communication alternative to Skype for Business) trades on around 47x sales. This is compared to Microsoft's EV/Sales valuation of around 7.7x.

Slack and Zoom are 'high-flying' stocks that trade on such high valuations because they're expected to carve out decent slices of their respective markets. We believe the market is getting this wrong.

- Flexing its muscles through R&D

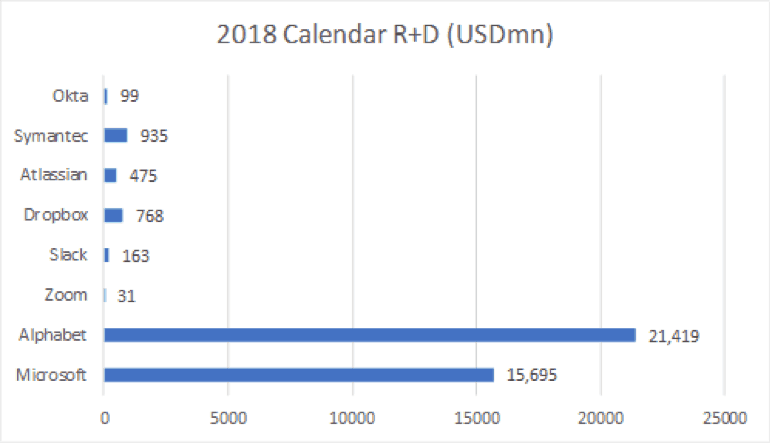

It's hard to see SaaS alternatives sustainably maintaining superior products. Like Google, Microsoft has an unparalleled research and development budget that should negate any specific product feature weaknesses over time.

Microsoft wasn't well positioned 8-10 years ago when most of the stand-alone SaaS 'high-flying'competitors were founded. This has, however, changed since Satya Nadella became CEO in 2014. Since then, Microsoft has been incredibly focused on developing SaaS capabilities in the core Office applications and started to compete strongly in new areas like collaboration, storage and planning.

The company is also using its established platforms to push into new areas.

The 'Dynamics 365' bundle integrates CRM, Marketing, Services, Financials and HR onto one common system and workflow. Dynamics 365 is attractively priced for most businesses and should grow to become a serious threat to traditional, well-known alternatives in the SMB space such as Salesforce, Zendesk, Hubspot, Atlassian and Xero (ASX: XRO).

- Unparalleled Growth

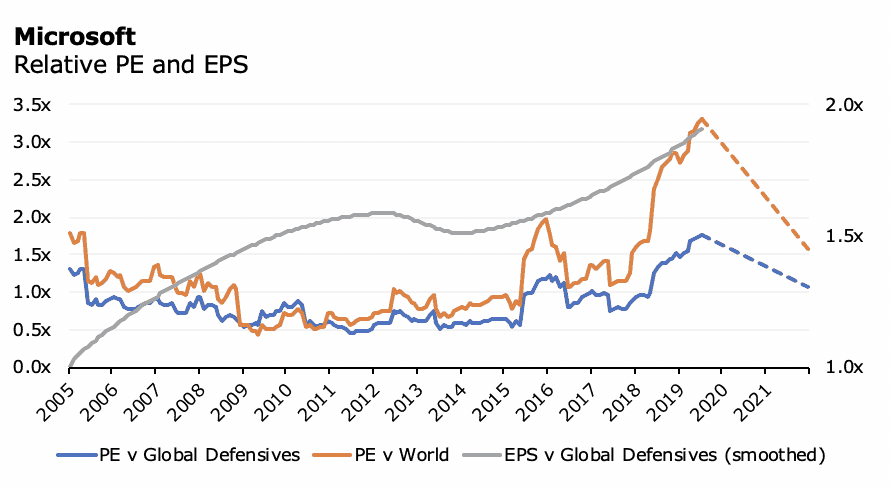

The chart below captures Microsoft's rerating against the broader market and also against the 'defensive quality growth sectors' – the aggregate of the global Software/Internet, Consumer Staples and Healthcare Sectors.

The third line captures Microsoft's growth against that peer growth. In summary, Microsoft trades at the average peer group multiple but is growing and we believe will continue to grow at twice the peer group average. At the very least Microsoft is an 'inexpensive' defensive, growth opportunity.

Microsoft has been a top 10 position for Antipodes since inception and we continue to think the company is well positioned for unforeseen changes in technology trends going forward, largely due to its recent cultural change, strong sales force and bundling capabilities.

At the very least Microsoft is an 'inexpensive' defensive, growth opportunity.