CSL Limited (ASX: CSL) really is one of the most remarkable companies listed on the ASX.

The company is a case-study in the relentless value creation that can come from pricing power and long-term shareholders have seen their wealth compound at incredible rates of return.

But how does CSL Limited really make its money?

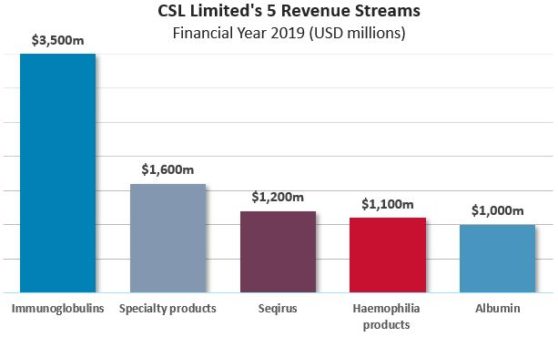

CSL's highly specialised products can be sorted into five product categories:

Source: compiled from CSL 2019 Annual Report

Immunoglobulins (42%)

These are antibodies used by the immune system to protect us against illness. CSL's products in this category, including Hizentra, are used to treat and prevent infections and to treat autoimmune diseases.

People often need these products if they are born without the immunities and antibodies they need, known as Primary Immunodeficiency. According to research in the Journal of Molecular Diagnostics, this impacts 1-in-500 people in the United States.

Other/Specialty products (19%)

This category includes a range of products like Kcentra, which helps blood clotting in patients that need urgent surgery but are taking the blood thinner Warfarin, which prevents blood clots.

Another example is Berinert, which treats the rare Hereditary Angioedema condition. This is the lack of a certain blood protein which can cause painful and dangerous swelling.

Seqirus (14%)

Seqirus is easier to understand, it's CSL's influenza vaccines business, researching and manufacturing vaccines. It is one of the largest influenza vaccine providers in the world and a growing part of the business, with revenue in the 2019 financial year up 12%.

Haemophilia products (12%)

These products help blood clotting and include products to treat Haemophilia A, B and other acute bleeding disorders. The products also go by the delightful term "plasma-derived coagulation products".

Albumin (14%)

Albumin is the most common type of protein found in our blood plasma and its role is to stabilise blood pressure. CSL's Albumin products help to restore blood volume and pressure in patients after trauma or surgery. It is also used for treating burns.

Foolish takeaway

The products CSL sells are well regarded and protected by patents which provide a strong competitive advantage.

If CSL continues to manage the risks that come with manufacturing biotech products I would expect it to continue growing at high rates of returns for years to come. It is one of very few companies I would be willing to pay a premium price to own.