The LiveTiles Ltd (ASX: LVT) share price won't be going anywhere today after the fast-growing intelligent workplace intranet platform provider requested a trading halt.

Why are LiveTiles shares in a trading halt?

This morning LiveTiles requested a trading halt whilst it undertakes a material non-underwritten capital raising which will involve a placement to institutional and sophisticated investors.

According to its investor presentation, LiveTiles is looking to raise up to $50 million through the issue of 142.9 million new shares at 35 cents per share. This will be a discount of 12.5% to its last close price of 40 cents.

In addition to this, LiveTiles will also conduct a non-underwritten share purchase plan to existing eligible shareholders capped at a total aggregate of $5 million.

Management advised that the proceeds will go towards sales and marketing resources, partner channel development, ongoing product development and enhancement, business integration, and general working capital purposes.

Business update.

The company also took this opportunity to provide the market with a business update. Whilst no new numbers were revealed, management advised that it expects LiveTiles to deliver another year of strong customer and revenue growth in FY 2020.

This is thanks to its large and growing addressable market, growing demand for artificial intelligence products, continued growth in the partner/reseller distribution channel, its focused direct sales and market strategy targeting larger enterprises, and high-impact co-marketing initiatives with tech behemoth Microsoft.

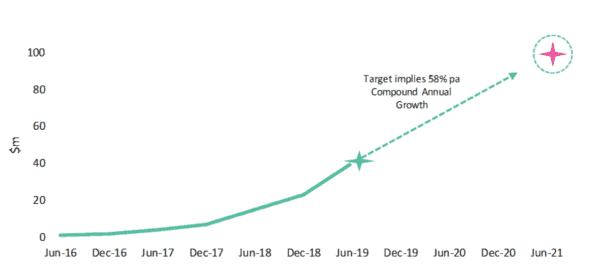

It also reiterated its medium term target of organically growing its annualised recurring revenue (ARR) to at least $100 million by 30 June 2021. This can be seen on the chart below:

LiveTiles' placement is expected to be complete on Thursday, after which its shares will return to trade soon after. Finally, settlement of the new shares is expected to be on Monday September 23.