The iSignthis Ltd (ASX: ISX) share price certainly has been on a rollercoaster ride this week.

After rocketing to a record high of $1.76 on Monday, the payments company's shares have crashed a whopping 47% lower to 93 cents.

Based on the 1.093 billion shares it has on issue, this means the company went from a market capitalisation of ~$1.9 billion down to around $1.1 billion today. That's a massive $800 million in market value gone in just three days.

Why has the iSignthis share price been crushed this week?

Investors have been hitting the sell button in a panic this week after analysts at governance advisory service Ownership Matters criticised the fast-growing company.

The Ownership Matters report questioned the release of performance rights for 336.6 million shares to the company's top executives.

These rights had certain performance hurdles that had to be met. On one particular occasion the company's revenue surged suddenly and led to it meeting its target by a margin of just $1347.

The governance advisory service firm noted that there was limited disclosure in relation to what drove the material revenue increase that allowed the company to meet its target. It also pointed out that revenue suddenly declined materially soon after.

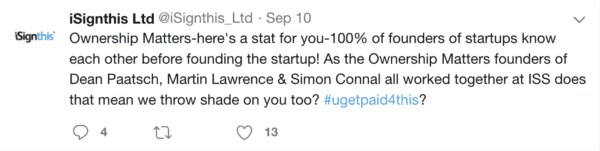

This report didn't go down well with iSignthis and led to the company posting on Twitter.

This doesn't strike me as the type of behaviour you would expect from a company generating over a billion dollar in gross processing transaction volume (GPTV) a month and could have contributed to its downfall this week.

What now?

Whilst there is a lot to like about iSignthis and this sell off could one day prove to be an incredible buying opportunity, there are just too many red flags at this point for my liking.

In light of this, I would suggest investors stick with Afterpay Touch Group Ltd (ASX: APT) and Zip Co Ltd (ASX: Z1P) for exposure to the payments industry.