The NIB Holdings Limited (ASX: NHF) share price is up nearly 5% today after the company released an 'error correction' statement to the ASX before trading opened this morning. NIB shares closed yesterday at $7.17, but have reached the $7.51 mark at the time of writing – a bump of 4.67%.

What was the error that needed correcting?

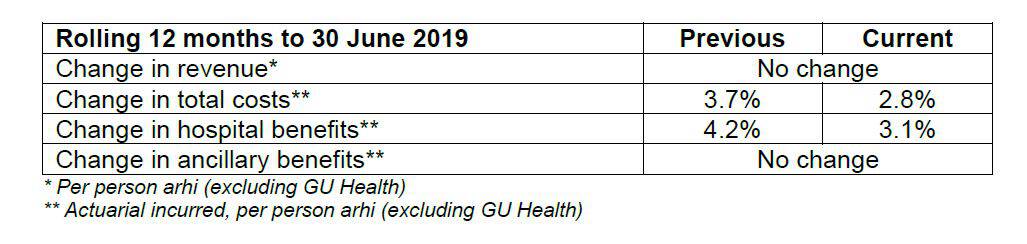

In its earnings report for the 2019 financial year that was released to investors on 19 August, the company included a claims cost inflation chart for its Australian residents health insurance arm "illustrating the rolling 12 month change in revenue, total costs, hospital and ancillary benefits per person" for the businesses. This chart was discovered to contain two errors, which you can see below:

The company stated the following in regards to the changes:

It is emphasised that the error related only to the claims data used to construct the chart presented in the 2019 Full Year Results Investor Presentation. It did not impact the data correctly used to inform underlying inflation assumptions and forecasts relating to FY20.

nib's FY20 guidance is not impacted as remains unchanged, with FY20 underlying operating profit to be at least $200 million (statutory operating profit of at least $180 million).

Shares of NIB fell more than 6% after the 2019 results were released in August, and today's upward moves still don't put the NIB share price above the pre-results level, let alone get it close to the all-time high the company reached on 29 July of $8.20. Nonetheless, NIB shares are still up 46% since the start of the year, so it's not likely too many are complaining.