Amazon boss Geoff Bezos has often talked about it as the most important operating metric for any fast-growing consumer-facing tech business to deliver on.

In fact during the early days of Amazon critics often labelled Bezos a fool for focusing on this metric too much ahead of profitability.

Given Amazon is now nearly the world's largest company it seems Bezos was correct in claiming this metric must be delivered before all others if you want to build a successful consumer-facing blue-chip business of tomorrow.

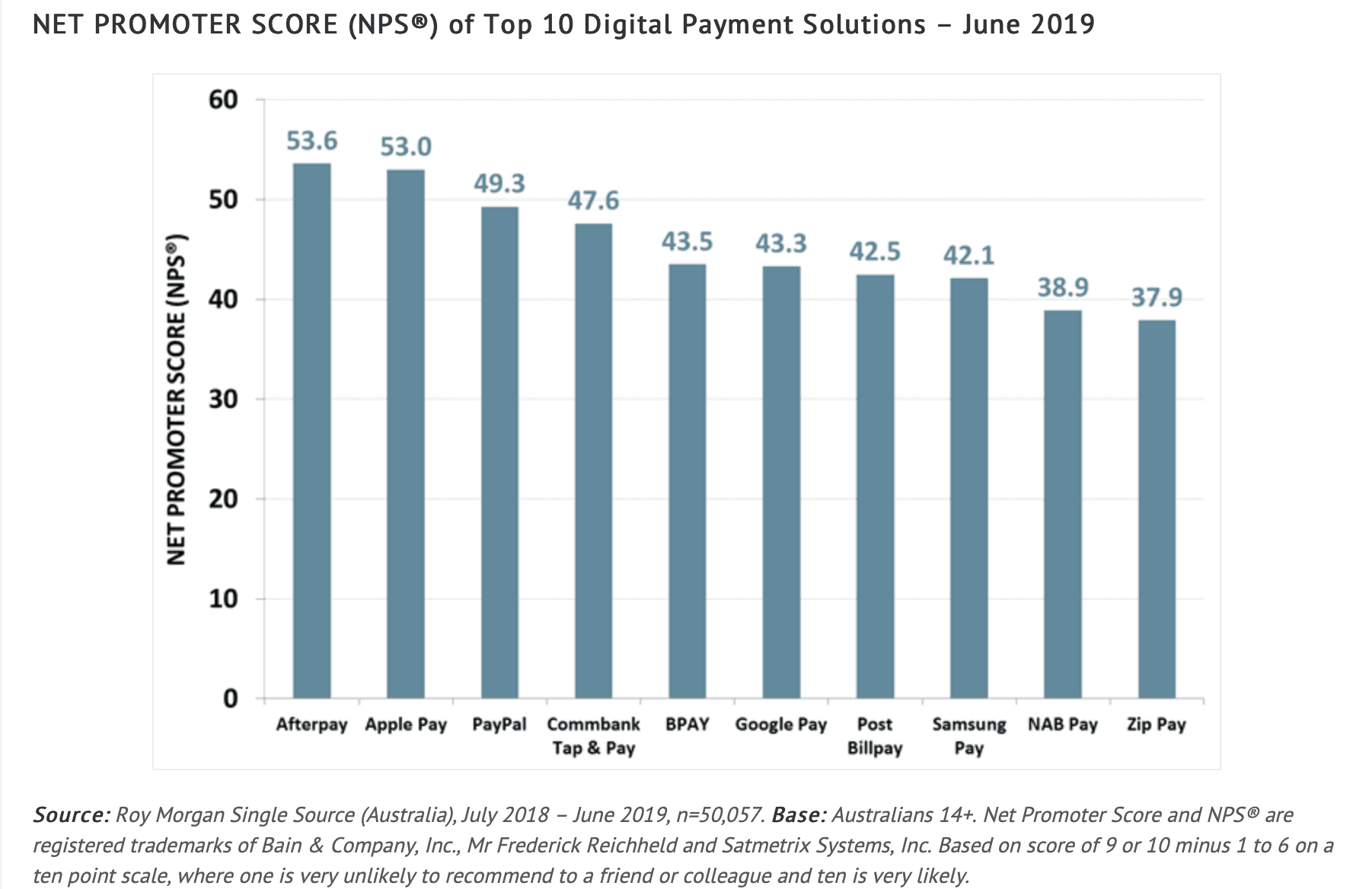

Fortunately for Afterpay Touch Group Ltd's (ASX: APT) evangelical-like base of shareholders according to a Roy Morgan Single Source Australia survey it's now ahead of tech giants like Apple Inc. Google, PayPal and Samsung on this operating metric.

So what metric am I talking about?

AML / KYC compliance. Nope, only kidding.

It's customer satisfaction of course.

Check out the table below that shows just how much Afterpay's user base loves the product.

Source: Roy Morgan, September 6, 2019.

Customer satisfaction is crucial to every consumer-facing business because the more customers enjoy a product the more likely they're to use it again.

Afterpay's business model is largely a scale game given the very skinny margins, while regular users are also more valuable as the credit risk is lower the longer a customer's track record of paying it back on time.

Regular users also involve less pesky admin or cost in terms of on-boarding and verifying a new user's ID for example, as such they're higher margin.

The point for investors is that in having a 'net promoter' score ahead of payment giants like Apple, Google and PayPal it seems Afterpay's alternative to a credit card product is wildly popular.

That's backed up by its astonishing growth rates in Australia, the US and UK, with it reportedly attracting over 12,500 new users per day in August 2019!

Its breakneck growth has even see Afterpay become a verb like Google, as users 'afterpay' purchases and talk of before and afterpay.

For investors if Afterpay's launch does prove a seminal moment in how developed world consumers access short-term retail credit then the company's value and stock will probably run higher.

However, it's operating in an increasingly competitive space (rival ZIP Co. Ltd is also on the chart) where its margins (what it charges retailers) could come under pressure.

Therefore any investment in Afterpay should only be a small part of a balanced investment portfolio.