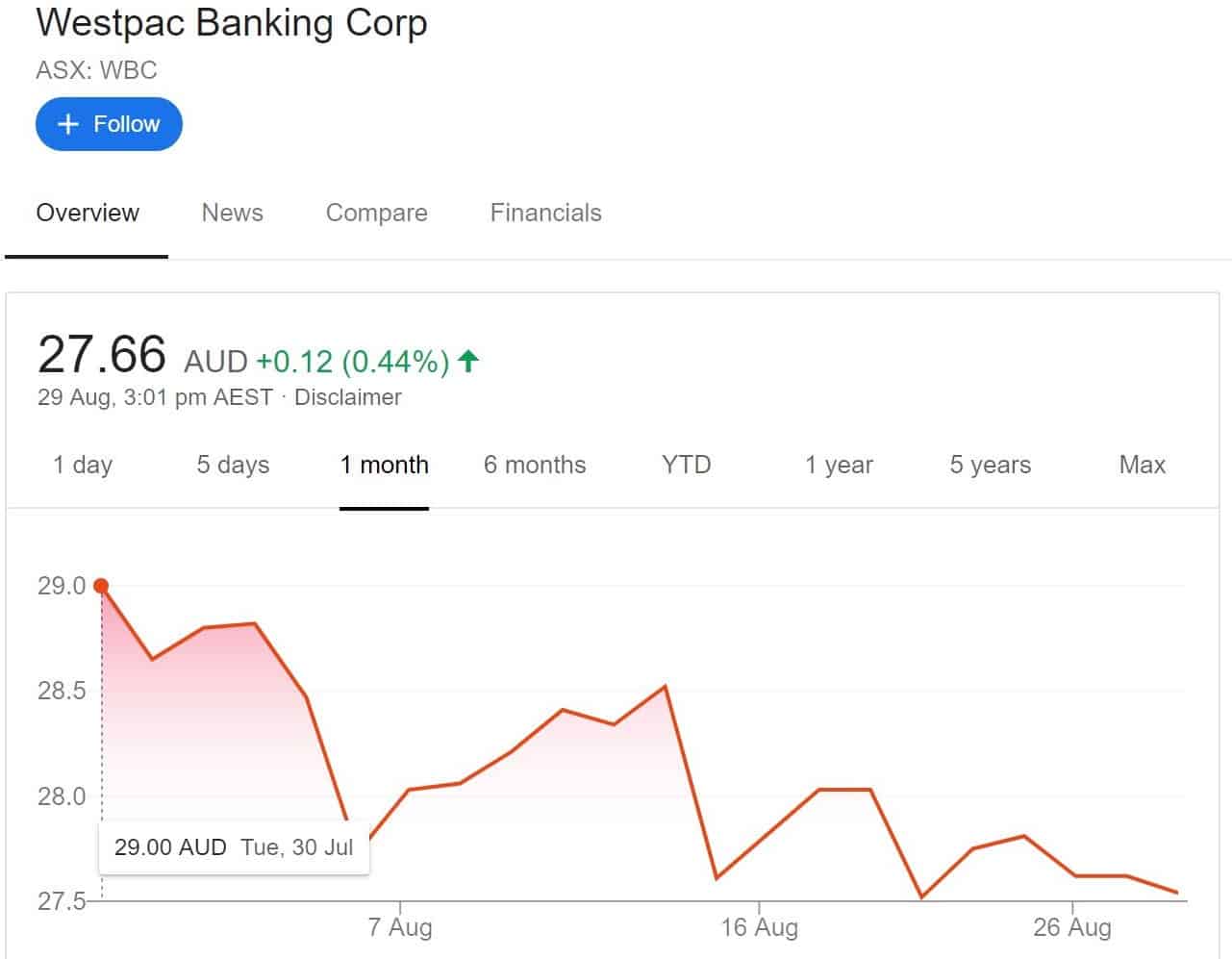

The Westpac Banking Corp (ASX: WBC) share price has fallen nearly 5% over the course of this month, with WBC shares dropping from $29 at the end of July to the $27.66 levels we are seeing today (at the time of writing).

Westpac shares have been on a positive trajectory in 2019 so far (rising 12% YTD after starting the year at $24.44) so the month-long slump we are seeing is a reversal of sorts of this trend. So what's behind this pull-back? And more importantly, are Westpac shares a buy today?

What's Westpac's year been like?

Westpac's positive year can be attributed to two big drivers (in my opinion).

Firstly, the outcomes for the 2018 royal commission were finalised. The results from the commission were not as bad as many were expecting. Although Westpac (like all of the 'Big Four' banks) has had to shell out cash to compensate customers from its past misdeeds, major regulatory changes that would have affected the banks' profitability that many investors were fearing were not recommended by the Commission's final report.

Secondly, the Coalition government's victory in the May federal election meant that changes to refundable franking credits and a wind-back of negative gearing that the Labor Party was proposing are no longer on the horizon (both of these policies would have damaged Westpac's valuations). Most investors (and everyone else) were expecting a Labor win and so the surprise Coalition victory led to investors pricing these changes out of Westpac shares.

What about August?

The 5% drop in Westpac shares over August can be attributed to the market gyrations that the ongoing Sino-US trade war have caused. The ASX200 (ASX: XJO) index is still notably down from the record highs that were reached in July, and (as a large component of the ASX200) Westpac shares are heavily influenced by whole-market moves. After all, as a bank, Westpac rises and falls on the strength of the overall economy, and the international tensions we have recently seen have dampened expectations of higher growth.

Foolish Takeaway

As the Westpac share price is still substantially more expensive than where it started the year, I wouldn't say that this August pull-back is a major buying opportunity. Although WBC shares are still offering a 6.82% yield on today's prices, anyone who's not desperate for a big dividend yield would be better off waiting for a cheaper entry price (in my opinion, anyway).