The way I like to think about ASX-listed oil and gas producers like Woodside Petroleum Limited (ASX: WPL) and Santos Ltd (ASX: STO) is that they are a portfolio of individual projects.

Each project has its own capital requirements and expected return and, if the company has been conservative with its numbers, the project will gush cash for years, even decades, to come.

To get this winning outcome a project needs three things:

- A design centred on minimising unit production costs

- Superb project execution (minimal delays or cost overruns)

- Precision timing to meet maximum global energy demand

If Woodside Petroleum can achieve all three when it joins Chevron on the 40-year Kitimat LNG project in Canada, it could make Woodside shares worth holding today for decades to come. So how is the project tracking?

1. Cost-focused project design

Woodside is known for its low-cost LNG production and has been working hard to ensure Kitimat is a global leader on production costs.

One of the most effective ways to minimise unit production costs is through increasing scale.

The latest design application for Kitimat involves a proposal to produce up to 18 million tonnes per annum (mtpa) of LNG over three trains. This is an increase from the original 10 mtpa design and would dwarf the size of Woodside's Pluto LNG which produces 4.9mtpa.

The monster LNG plant is also being designed to run entirely off renewable electricity in an attempt to reduce both costs and emissions.

2. Superb project execution

Project delays and cost overruns can quickly destroy the return on investment a large project can achieve.

Woodside Petroleum has proved to be a relatively effective developer of big LNG projects. Despite some cost overruns developing Pluto LNG, the company has been willing to shelve projects like Browse LNG if the economics do not stack-up.

Its partner Chevron… not so much, at least in Australia. The cost to develop the company's monster Gorgon LNG project was reported to have blown out by a disastrous 46%, taking the total project cost from a planned US$37 billion to US$54 billion.

Chevron's learnings and Woodside's prudence should result in a carefully managed project in Canada.

3. Precision timing for peak energy demand

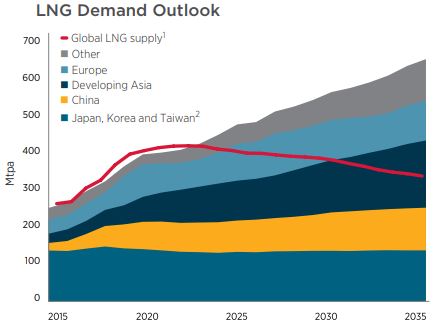

Over the next 15 years growth in LNG demand is forecast to significantly outpace global supply from capacity currently under construction.

Source: Woodside Petroleum 2018 Annual Report

Woodside is carefully timing the development of Kitimat to align with optimum global demand, but the timing is also likely to match a wave of long-term supply contracts as they come up for renewal.

Foolish takeaway

Despite the current slump in natural gas prices, if Woodside can carefully step through the design, execution and timing of the project, I think it could be a significant contributor to the company's project portfolio in the next decade.