This morning Woodside Petroleum Limited (ASX: WPL) released its results for the half-year ending June 30, 2019. Below is a summary of the results with comparisons to the prior corresponding half year. All figures in US$.

- Operating revenue was $2,260m, down 5%

- Net profit $419m, down 23%

- Free cash flow of $869 million

- Produced 39 million barrels of oil equivalent (Mmboe)

- Half year earnings 44.8cps, compared to 59.6cps

- Declared interim dividend of 36cps, down 32%

- Liquidity of $5,281m, +36% from H1 2018.

- Average LNG prices +5% across Pluto, Wheatstone, North West Shelf projects

"First half NPAT was lower compared to the corresponding period due to the impact of Tropical Cyclone Veronica, the planned maintenance at Pluto LNG, and the Ngujima-Yin floating production storage and offloading (FPSO) facility being offline for refurbishment in Singapore ahead of its restart at Greater Enfield," commented Woodside CEO Peter Coleman.

Woodside shares are down 5.7% to $31.53 today as investors react to the profit report and after a 5% tumble in Brent crude and WTI oil futures overnight on the back of market fears that a global recession is around the corner as the U.S. yield curve inverts.

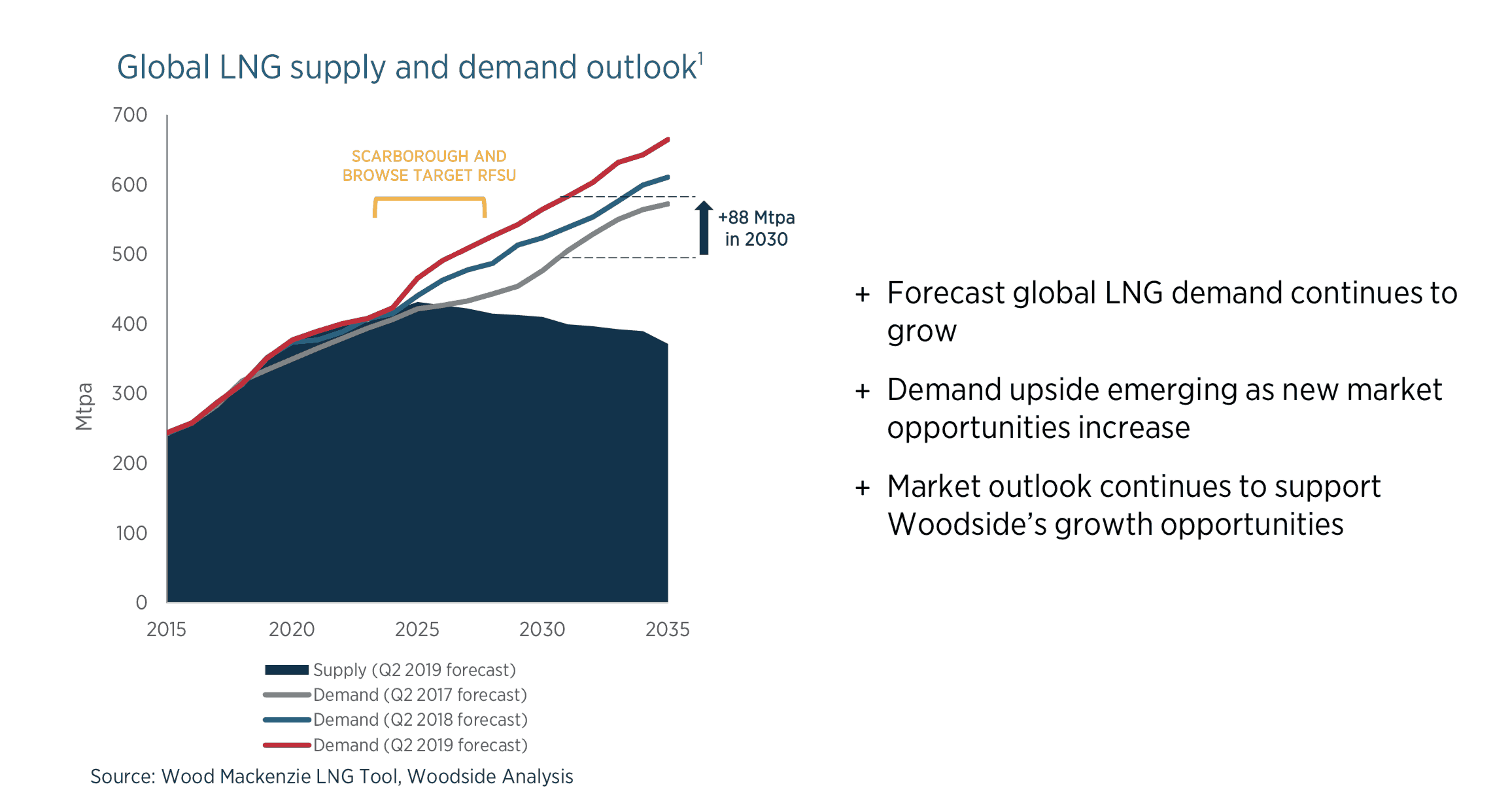

Woodside is primarily an LNG producer, but LNG prices are directly linked to oil prices, as such any investors need a bullish view on oil and LNG prices going forward. The company itself is predicting a strong rise in the demand for LNG out to 2035.

Source: Woodside Presentation, Aug 15, 2019.

If the analysis above is on the money then LNG giants like Woodside, Oil Search Limited (ASX: OSH) and Santos Ltd (ASX: STO) look well positioned to benefit. However, I'm not a buyer of these capital intensive, price-taking type businesses.