The Qantas Airways Limited (ASX: QAN) share price is down 2.5% to $5.38, despite the national airline not releasing any specific news to the stock market.

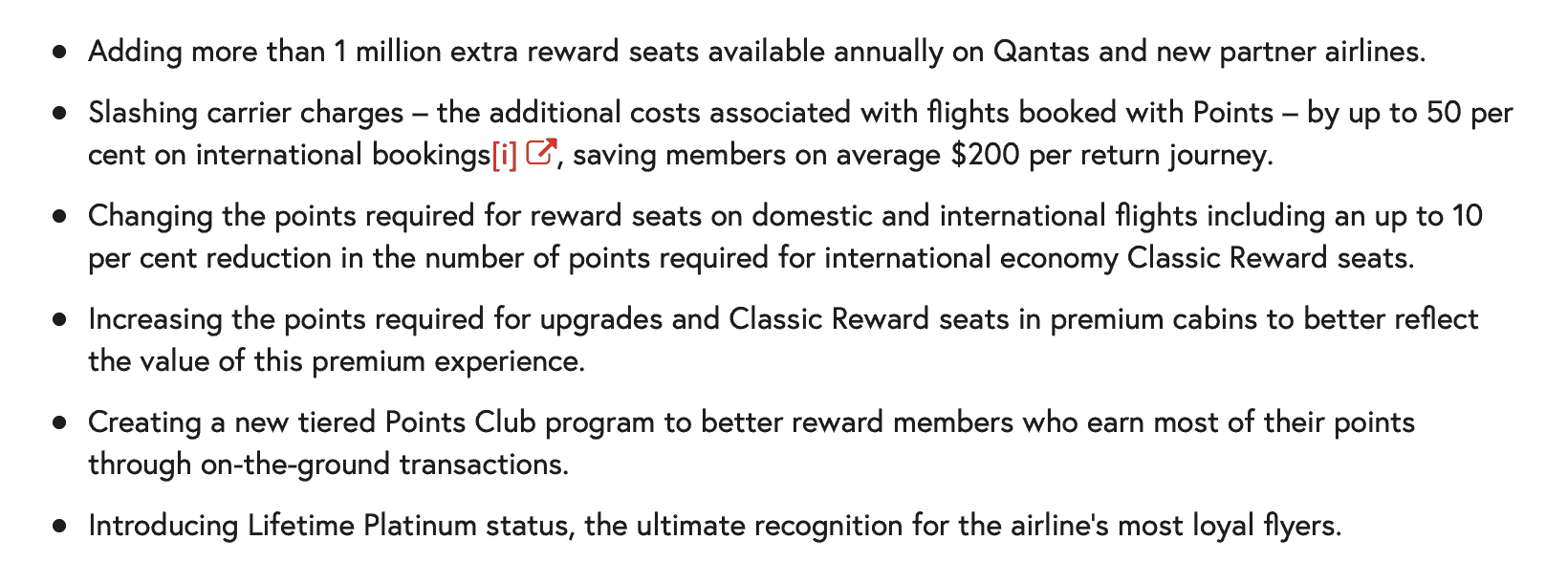

However, it did issue a media release this morning describing what it called the "biggest overhaul to its frequent flyer program in 32 years." Below is an excerpt of the media release detailing the key changes for frequent flyer members.

Source: Qantas Media Release, June 20, 2019.

According to its CEO, Alan Joyce, the changes are all about meeting customer demand for popular rewards, or put another way there about Qantas lifting its bottom line by increasing the amount of points needed to meet popular rewards such as upgrades to business or first class.

The airline will also be introducing a special reward points program to anyone who eats its economy class food, only kidding on that one, but it does look as though the new plan incentivises people to use points to book economy class tickets over business or first.

The frequent flyer program is a huge part of the business model that also now includes Qantas Money and Qantas Insurance as the deeper it can drag frequent flyers into its eco-systems the less likely they're to use an alternative airline like Virgin Australia Ltd (ASX: VAH) that also offers a reward program.

For the six months ending June 30 2019 Qantas is expecting 7% – 10% profit growth from its loyalty program.

The airline recently announced its spent around $160 million this half year on buying back shares, while also dishing out a 12 cents per share dividend to enrich shareholders further.

For the six months ending December 31 2018 it posted an underlying profit of $780 million on sales of $9.2 billion, with profit from the loyalty scheme up 4% to $175 million.

The stock and profits have soared under CEO Alan Joyce who implemented a radical cost cutting program including laying off a lot of staff and reportedly asking the remaining staff if they wanted to work for free over last Christmas!

Potential investors should remember that despite a profit-hungry CEO, this is a business with fixed and variable overheads.

For example the rising fuel bill could prove a continuing headwind (up $416m over H1 FY 19) while other costs are more fixed in that it cannot fly planes with less pilots or ground crew for example in response to rising oil prices.

I can also personally vouch that it doesn't have much room for cost savings on the economy class food.

As such this stock is not for the feint hearted.