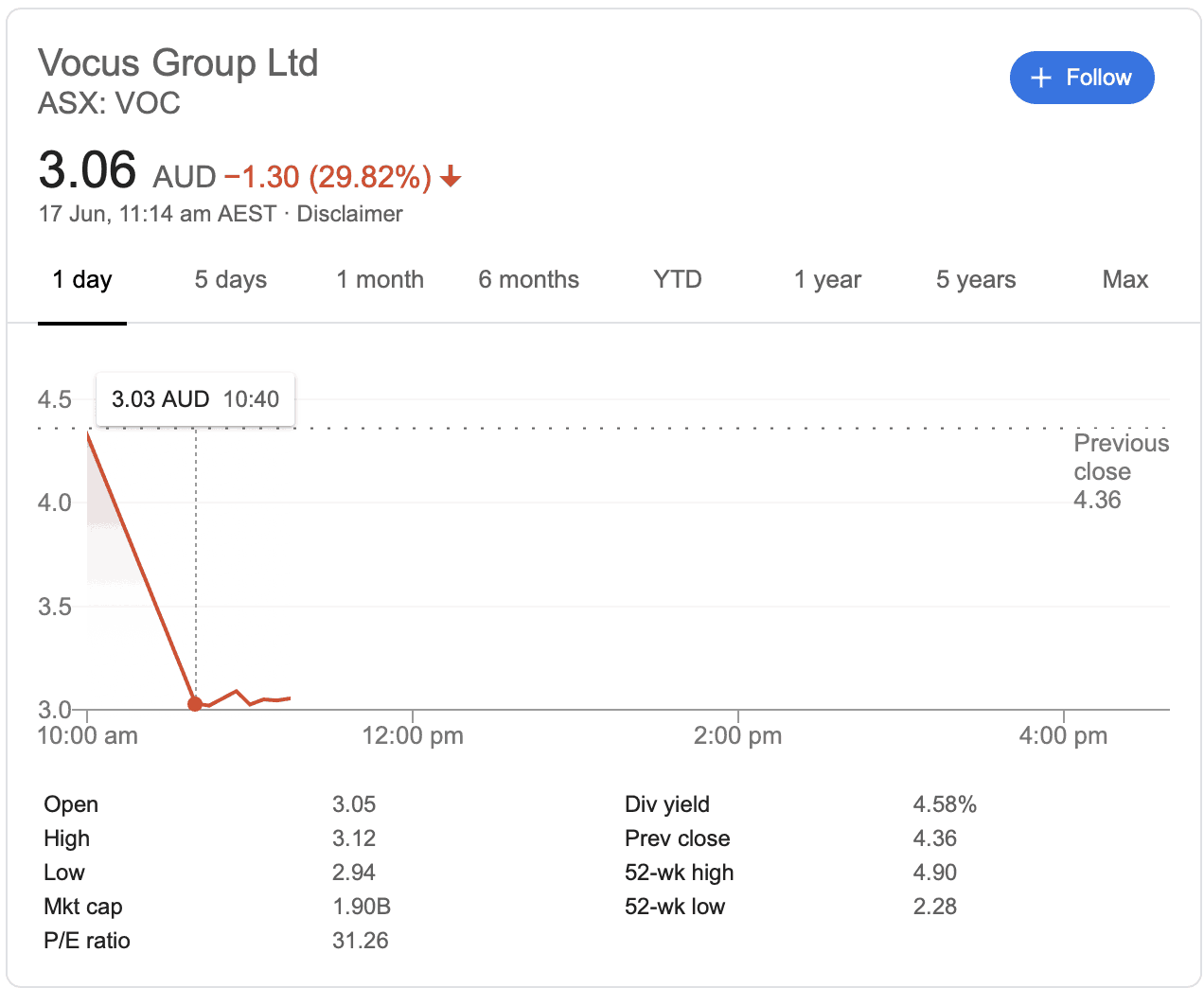

The Vocus Group Ltd (ASX: VOC) share price is down a whopping 30% this morning to $3.05 after its takeover bidder AGL Energy Ltd (ASX: AGL) announced it was pulling the bid after only one week's access to Vocus's data room to complete due diligence. AGL had made an unsolicited proposal to buy Vocus at $4.85 per share, but today the stock is trading 37% below that price.

Vocus shareholders might want to look away now.

Source: Google Finance, June 17.

The Vocus share price fall is probably so large as AGL is the fourth bidder in around 18 months to reject Vocus after taking a "look under the hood". Cynics might suggest Vocus still has a few skeleton in its closet then.

In response to today's news Vocus's CEO commented: "We have great confidence that our strategy and ability to execute our business plan will deliver significant value to our shareholders in the medium to long term. There is growing demand for our strategically valuable network assets and we have a substantial opportunity for Vocus Networks to gain market share. This is the core of our business."

One inference from this statement being that the NBN and home internet businesses of iPrimus and Dodo are not big priorities for the telco going forward.