Unfortunately for young Australians, having a university education inevitably means also having a substantial amount of student debt or "HECS-HELP" debt as it's known.

While HECS debt might be the "cheapest loan you'll ever get", should you consider paying down your student debt as part as a key personal finance decision?

How it all works

The way that public university education works in Australia is that the government provides students with the ability to pay for their tertiary education with borrowed money.

Unless you've got a spare $30,000 – $100,000 spare dollars lying around at university age, chances are you've got at least some level of student debt from your time at university.

While it's a great deal for students and is a key component of Australia's high level of education, students repay a percentage of this loan (~5% – 9%) from their salary once they reach a certain threshold (currently $55,874 per year). This is where the phrase "HECS debt isn't real debt" comes from, as many don't really consider it a personal debt because that money is taken from your salary as an effective tax – meaning you never really see it.

The loan is indexed to inflation, which means that while it is the cheapest loan you are likely to ever receive, it does compound at an approximate rate of 2% per annum.

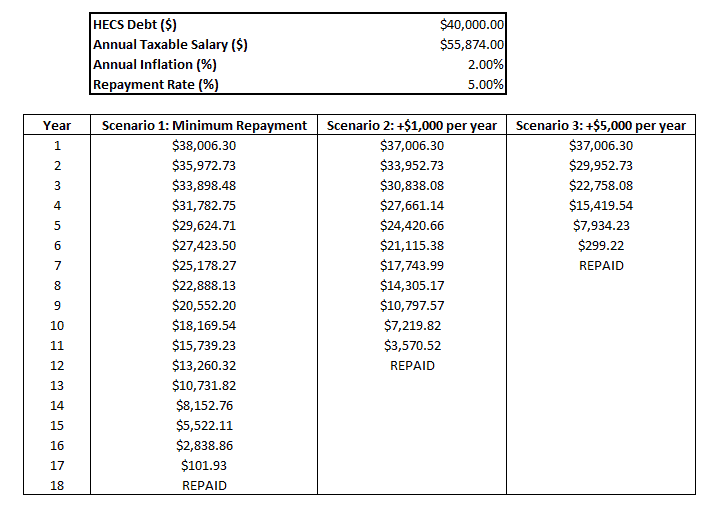

If you consider the below scenarios, you can see why there's a case for paying down student loans early.

Clearly, it pays to pay down debt as quickly as you can due to the compounding interest nature of the loan. $40,000 compounded at 2% per year for 4 years has a future value of $72,454.46 compared to $48,759.78 if compounded for just 10 years.

However, one of the generally accepted rules of personal finance is to always pay down your most expensive form of debt first and then move down to the cheapest, which again, is likely to be your HECS.

While everyone must work this out for themselves, paying off HECS early is likely a good decision if you have no other more expensive forms of debt such as a mortgage, car payments or a credit card bill owing.

In the meantime, growth-seeking investors who want exposure to new industries should check out this top-rated growth stock is in the buy zone and could be set to surge higher in 2019.