ASX lithium stocks have continued to struggle in making ground despite the wide acceptance and development of electric vehicles and lithium-ion batteries.

Why are lithium stocks falling?

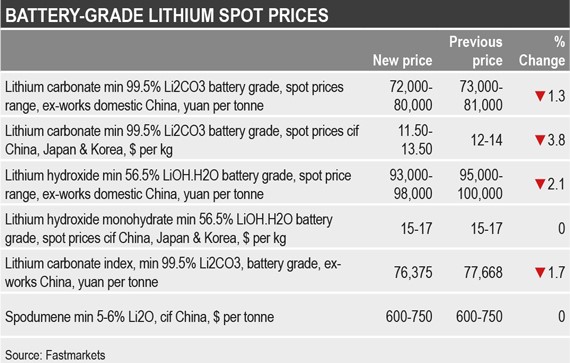

Like most material stocks, lithium producers are heavily dependent on the lithium spot price. Below is a chart of the latest battery-grade lithium prices.

To add more context to the prices, lithium carbonate min 99.5% Li2CO3 battery grade was trading at peaks of roughly RMB$160,000 – $180,000 per tonne back in late 2017. As prices have almost halved, producers such as Galaxy Resources Limited (ASX: GXY) and Orocobre Limited (ASX: ORE) will continue to see margins shrink. This may eventually put pressure on long term contract prices when they are due for renewal.

In a Fastmarkets report, it cited battery-grade lithium carbonate and hydroxide prices weakened on thin buying activity.

Have lithium stocks bottomed?

While I believe lithium stocks are great value, there is still more pain to be felt in the short term. Sentiment is still poor and lithium spot prices are still subject to poor demand/supply conditions.

At the same time, the electric vehicle industry is still in its early days with many vehicle manufacturers stepping up R&D to produce new electric vehicle models.

Government policy is also an important aspect of the demand for electric vehicles. We have yet to see much governmental support for electric vehicles, but the main leaders in this area are China, Canada, and Norway. For example, the Canadian government has recently announced a new $5,000 incentive program (that is not yet completed) to encourage more Canadians to buy zero-emission vehicles.

Foolish Takeaway

My favorite ASX lithium pick would be hard rock and brine producer Galaxy Resources given its cheap P/E valuation of only 5 and projected 2019 spodumene production to reach as high as 210,000t.

I also like Pilbara Minerals Ltd (ASX: PLS) for its large spodumene deposits and ambitious goal of becoming one of the top three lithium raw material producers by 2020, as well as Kidman Resources Ltd (ASX: KDR).

However, I believe more time is needed for ASX lithium stocks to make an appealing investment case. Investors need to see improvements in the lithium spot price, which has yet to make a meaningful reversal. Demand and supply conditions are still subdued with lower offer prices combined with a slow market. European and US spot prices also remain flat on the back of most lithium consumers covered by long-term contracts.

I believe more patience is needed and will keep ASX lithium shares on my watchlist for now.