In 2018 the S&P/ASX 200 (Index: ^AXJO) (ASX: XJO) gave back the strong gains it built up through to August to finish the year with a decline of 6.9%.

This was a major disappointment and meant the benchmark index fell well short of what leading brokers had predicted at the start of the year.

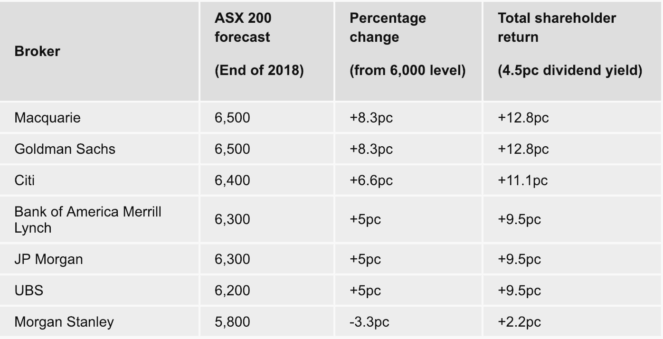

As you can see on the table listed below, courtesy of the ABC, equity analysts at Macquarie Group Ltd (ASX: MQG) and Goldman Sachs had been tipping a rise of 8.3% to 6,500 points.

As it turns out, the bears at Morgan Stanley were the most accurate with their prediction of a 3.3% decline to 5,800 points.

Will things be better in 2019?

According to the AFR, a number of analysts are positive on the ASX 200 pushing notably higher in 2019.

Stephen Koukoulas from Market Economic has predicted that the benchmark index could rise as much as 20% towards the 6,500 level. This could be "aided by more accommodating monetary policy and a turn in the housing market."

Elsewhere, Stephen Roberts from Laminar Capital is also bullish on the local market this year.

Mr Roberts has predicted a gain "somewhere between 8 to 12 per cent in 2019." Although economic growth is moderating, he expects fading concerns about the future to help drive the share market higher.

Over at AMP Limited (ASX: AMP), its chief economist Shane Oliver is a little less bullish but remains positive on the share market's prospects this year. He believes that the ASX 200 could reach the 6000-point mark again by December. This equates to a gain of just over 6% from its 2018 close price.

What now?

As you can see from the forecasts for 2018, predicting where the share market goes in 2019 is an impossible task.

I believe a lot will depend on the way that Commonwealth Bank of Australia (ASX: CBA), Westpac Banking Corp (ASX: WBC), and the rest of the big four perform. Due to their weighting in the index, if they return to form in 2019 then it could be a big lift for the market.

The good news is that I'm optimistic that their relatively cheap share prices and generous dividends means there's a strong chance they will rebound in 2019, underpinning the rest of the market. But only time will tell if this is correct.