There isn't a sector more morbid than the funeral industry. Yet, it's one of the ones that I'm most attracted to at the moment.

In Australia there are two main listed players, being InvoCare Limited (ASX: IVC) and the newer Propel Funeral Partners Ltd (ASX: PFP). Between them they likely account for more than 40% of the Australian market after recent acquisitions.

Over the past year the Propel share price has fallen 19% since its initial opening price and the InvoCare share price has fallen by 29%.

There appear to be three main causes for their share price declines.

- Price competition is a worry, particularly with an example in the UK of a major player heavily reducing prices – however Australia doesn't have any large not-for-profit operators to compete with (yet)

- The number of deaths has decreased compared to the expected amount this year

- Rising interest rates have decreased the attractiveness and valuations of shares

However, with all that in mind, I think the fall in share prices means InvoCare and Propel are now good ultra-long-term buys for two main reasons:

Very defensive

Sadly there is almost a guaranteed number of deaths each year. It's unavoidable, along with taxes. However, safety innovations and healthcare developments are helping lower the death rate – which thankfully, but only inevitably, delays things.

InvoCare and Propel can look forward to a certain level of revenue and profit each year. This means they could be very dependable in a market downturn. InvoCare seemed unfazed by the GFC with its reliable dividend payment.

Defensive earnings allows me to sleep a little easier at night.

Long-term growth

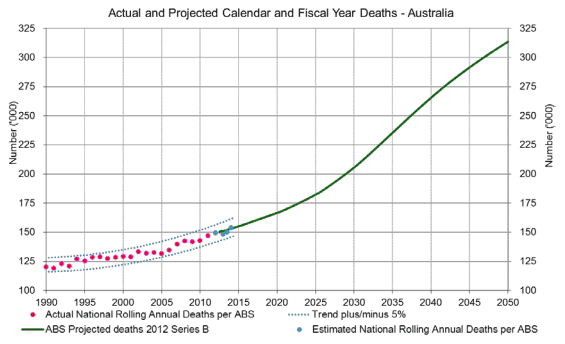

Death volumes are expected to grow by 1.4% per annum between 2016 to 2025 and then increase by 2.2% per annum from 2025 to 2050. There are very few businesses on the ASX that can point to underlying growth of their industry for the next three decades.

On a graph you can see the long-term growth projections:

Foolish takeaway

All InvoCare and Propel need to do is maintain (or grow) their market shares, achieve gentle price increases of their funerals and grow the number of funerals performed. If they can do that then they should generate decent returns for shareholders. A growing stream of dividends is also attractive.

InvoCare is currently trading at 23x FY19's estimated earnings and Propel is trading at 20x FY19's estimated earnings. Whilst neither are cheap I think now could be a good time to buy whilst short-term problems are affecting them.