The share price of Boral Limited (ASX: BLD) is clawing back from recent losses and I believe this is one stock that's primed to rally over the next six months.

The building materials group announced today that it's sold its US Block business for US$156 million ($216 million) to shore up its cash balance as it decides on the buyout of its USG Boral joint venture.

The stock has collapsed into a "bear market" with Boral crashing 22% from its peak in February when the S&P/ASX 200 (Index:^AXJO) (ASX: XJO) index is down 4%. A drop of 20% or more is technically a bear market.

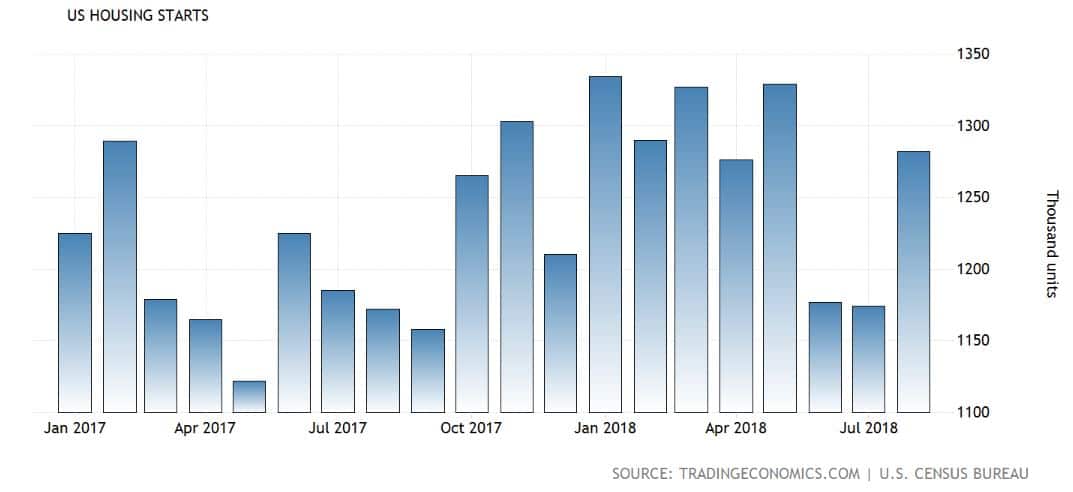

There are a few factors for the sell-off but it's the weak US housing starts data for the months of June and July that have been the latest drag on the stock.

However, housing starts are bouncing back with August recording a 9.2% jump from the previous month and beating expectations for a 5.8% increase, according to TradingEconomics.

Start-Stop-Start: US housing starts starting to recover

The average is still below the longer-term trend but the massive rebuild from Hurricane Michael in the Florida Panhandle and Hurricane Florence in North Carolina will likely see an increase in demand for Boral's products.

The sale of US Block is not material to Boral but it gives management greater flexibility as it weighs up its options on USG Boral following the merger between Knauf and USG. The ASX-listed partner has the right to take full ownership of the business or form a JV with the newly merged entity.

Boral provides investors exposure to two potential tailwinds – a strong US dollar and robust US economic activity.

While the US currency is giving up some ground in recent days, I am expecting the greenback to be well supported against the Australian dollar. Although I am mindful that a blowout in US government debt may trigger a sharp retracement in the greenback – I suspect that will be a late 2019 issue.

This means the next six months should provide a clear run for stocks like Boral. Others that are well placed to benefit from the two tailwinds include fellow building materials supplier James Hardie Industries plc (ASX: JHX), and plumbing products company Reliance Worldwide Corporation Ltd (ASX: RWC).

Another that may see some benefit from the thematic is bathroom fittings and products group Reece Ltd (ASX: REH).

But these aren't the only stocks that are well placed to benefit from tailwinds. The experts at the Motley Fool have picked three of their favourite blue-chip stocks for FY19 and you can find out what they are by following the free link below.