The Freedom Foods Group Ltd (ASX: FNP) share price will be on watch this morning after the diversified food company released its full year results after the market close on Thursday.

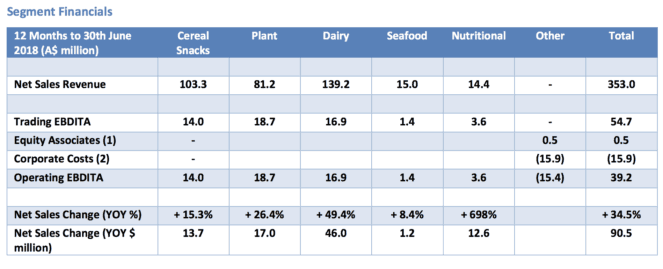

For the 12 months ended June 30, Freedom Foods posted annual net sales of $353 million, operating earnings before depreciation, interest, tax and amortisation (EBDITA) of $39.2 million, and operating net profit of $19.4 million. This was a 34.5%, 49.5%, and 96.9% increase, respectively, on FY 2017's results.

On a per share basis operating earnings came in 42% higher at 9.25 cents. This strong growth allowed the board to lift its final dividend to 2.75 cents per share, bringing its full year dividend to 5 cents per share.

Management believes the result reflects a positive operating performance within a period of significant change for the company. This includes the completion of its new state-of-the-art UHT dairy and plant-based beverage processing facility at Ingleburn, the transfer of operations from the Taren Point site to Ingleburn, the expansion of capabilities at Shepparton and Leeton, and investment in expanding packaging formats and technology platforms.

As you can see above, the key driver of growth in FY 2018 was the company's Dairy segment. This segment grew sales by 49.4% to $139.2 million, making it the company's biggest contributor to sales by some distance. Management advised that its Dairy operations at Shepparton achieved significant sales growth on the back of increasing demand in Australia, China and South East Asia.

The company's second-biggest segment, the Cereals and Snacks segment, also had a strong year and delivered a 15.3% increase in sales to $103.3 million. This reflected growth in sales in branded and non-branded activities in Australia and China.

The Nutritionals segment saw sales grow 698% to $14.4 million during the 12 months. This was driven by increased sales of high margin Vital Strength powder based branded products and new product launches in bar and beverage formats.

The company's Plant-Based Beverage operations (which included six months of production at Taren Point) posted a 26.4% increase in sales to $81.2 million. This reflected growth in retail and food service brands.

Finally, Freedom Foods' Seafood segment delivered an 8.4% increase in sales to $15 million. However, this was largely offset by unfavourable cost of goods and exchange rate impacts on purchasing canned salmon and sardines from Canada.

Outlook.

Management believes the company is increasingly well positioned to strategically build into a major global food and beverage business with scale in key food and beverage platforms.

It is predicting strong sales growth in FY 2019 due to its current portfolio, product range, and new contracts with key customers commencing in the first half of FY 2019. It has forecast net sales revenue in FY 2019 to be in the range of $500 million to $530 million, which will be a year on year increase of 41.5% and 50%.

Beyond FY 2019 management expects the full benefit of increased demand and capital expenditure initiatives to further grow sales and earnings into FY 2020 and beyond.

Should you invest?

Based on this result Freedom Foods' shares are changing hands at a lofty 63x operating earnings. While this is expensive, given its strong growth this year and positive outlook over the medium term, I feel it could be a good buy and hold investment option along with the likes of A2 Milk Company Ltd (ASX: A2M) and Bellamy's Australia Ltd (ASX: BAL).

Though, due to the premium its shares trade at, it is a reasonably high risk investment and could be unsuitable to some investors.