It has been a disappointing day of trade for ELMO Software Ltd (ASX: ELO) share price.

In early afternoon trade the shares of the provider of SaaS, cloud-based HR & payroll solutions are down almost 13% to $6.55 following the release of its full year results.

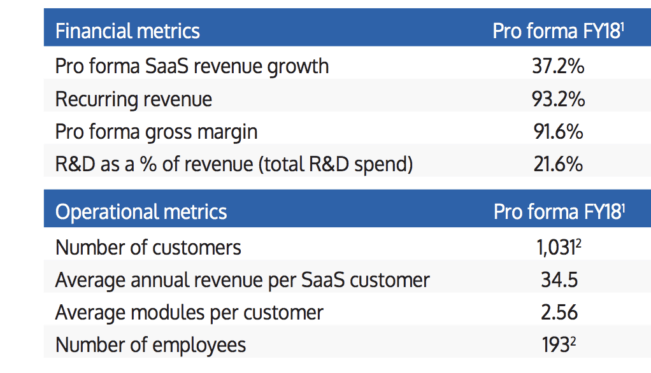

In FY 2018 ELMO achieved pro forma revenue of $31.9 million and pro forma SaaS revenue of $29.8 million. This beat management's upgraded guidance and meant growth of 36.4% and 37.2%, respectively, on the prior year.

This revenue was driven by the almost doubling of its customer numbers from 524 to 1,045 and a 3.9% increase in average revenue per SaaS customer to $34.50. As you can see below, 93.2% of this revenue is classed as recurring, giving the company a strong foundation to build on in FY 2019.

The strong sales growth and its expanding margins meant that pro forma EBITDA grew at the even quicker rate of 122.5% to $2.7 million. Including the acquisitions it made this year, EBITDA came in at $5.7 million.

Outlook.

Management has stated that the size of its target market in the ANZ region is ~12,029 organisations, of which it currently has a ~9% share. This total addressable market is estimated to be worth ~$1.7 billion.

The company is expected to win a greater slice of this market this year and management has forecast revenue growing 23.8% to $39.5 million, with SaaS revenue predicted to drive the growth with an increase of 26.8% to $37.8 million.

However, management has only forecast EBITDA of $1.1 million, which may explain why investors have hit the sell button today.

Should you invest?

Although I thought ELMO delivered an impressive full year result today, its guidance for FY 2019 was rather underwhelming and has overshadowed FY 2018's stellar performance.

When the dust settles it might be worth weighing up things and considering another bite at this lower price, but for now I intend to keep my powder dry.

Instead, I will be looking at fellow tech shares Citadel Group Ltd (ASX: CGL) and Megaport Ltd (ASX: MP1).