The Speedcast International Ltd (ASX: SDA) share price has been the worst performer on the All Ordinaries on Tuesday with a massive 35% decline to $4.35.

Although its shares have rebounded slightly, they still sit 32% lower at $4.55 in afternoon trade following the release of its half year results.

Here's how Speedcast performed compared to the prior corresponding period:

- Revenue grew 24% to US$304.9 million.

- Underlying EBITDA increased 14% to US$60.4 million.

- EBITDA margin narrowed by 180 basis points to 19.8%.

- Underlying NPATA grew 37% to US$21.1 million.

- Net debt increased to US$430 million.

- Fully franked interim dividend of 240 Australian cents.

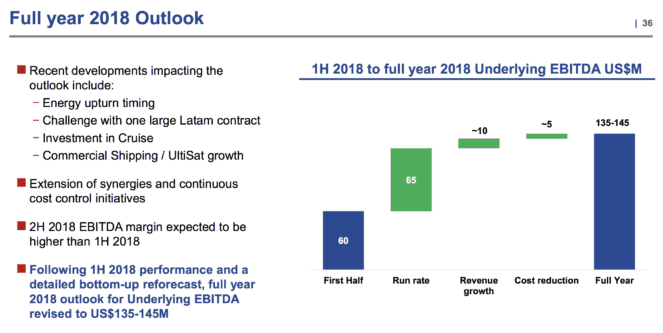

- Outlook: Underlying FY 2018 EBITDA to be in the range of US$135 million to US$145 million.

Overall, I thought this was a solid first half performance from Speedcast with three out of its four divisions delivering robust growth compared to the prior corresponding period.

The Maritime division grew revenue by 10% to US$106 million. This was driven primarily by high growth in its Commercial Shipping business from increased VSAT activations and some bandwidth growth in its Cruise business.

EEM revenue grew organically by 29% in the first half to US$75 million. The catalyst for this positive performance was the first phase of the NBN contract in Australia and growth in wholesale voice activity.

Speedcast's Government division saw revenue increase 17% on a pro forma basis. This was driven by the Ultisat acquisition and increased US defence spending.

The Energy division was the only disappointment in the first half. Energy revenue fell 17% to US$76 million due to the delayed recovery in the offshore energy sector. This resulted in higher than expected industry churn and pricing pressure. The division was also impacted by delays in certain projects and one-time customer effects.

Outlook.

While the Energy division's performance was disappointing, it was the company's outlook that sent shareholders to the exits in a hurry today.

As shown above, management provided underlying FY 2018 EBITDA guidance in the range of US$135 million to US$145 million. This is down from guidance of ~US$155 million reiterated as recently as the end of May.

Should you invest?

Based on today's result and its earnings per share of 8.8 cents, Speedcast's shares are trading at approximately 25x annualised earnings. While that may prove to be fair for the company, I intend to wait and see how it performs in the second half and the guidance management gives for FY 2019.

In the meantime, I would sooner look at the shares of industry peers Superloop Ltd (ASX: SLC) or Macquarie Telecom Group Ltd (ASX: MAQ).