As a fairly young investor I am commonly asked by friends why I invest in the stock market.

By having these conversations, I have noticed how poor financial literacy rates are in young people in Australia. I am commonly asked questions like, "Aren't shares really risky?", "What if there is a stock market crash?", "Wouldn't my money be safer in the bank?", "Isn't buying shares just the same thing as gambling?".

Over the following series of articles, I will one-by-one address these questions, and in the process hopefully there are a few millennials out there reading.

They can pass on their newly acquired knowledge to their buddies, and slowly but surely, we can boost our cohort's financial illiteracy.

Question 1 – "Aren't shares really risky?"

Well that depends how you define risk. Financial theory defines risk as the expected variance of returns over a given period. If we take shares as an asset class, and then apply this definition over multiple 1-year periods, and compare the variation with other asset classes such as real estate, bonds, and cash, then shares will probably come out as the riskiest of the group.

But analysing an investment's performance over a 1-year period would not be a just assessment. When we invest in shares, we should really think of it as buying a business or a house. I mean that's literally what a share is, an ownership "share" in a company.

You would not usually invest a big chunk of money into a business or a house, to only sell it one year later would you? I mean maybe some people might, but that seems like a lot of effort to go to for not much reward.

Instead, we usually invest in a business or house for the long-term. We buy the asset because we believe that in 5-10 years or longer, it will be worth considerably more than what we bought it for, and will provide us with a steady stream of cash along the way.

The challenge is thinking about an investment in shares the same way. This can be hard to do with smartphones in our pockets, that give us 24/7 quotations of what our investment is selling for on the market.

Or with the 24-hour news cycle that we live in today that is constantly spreading sensationalist headlines like "the imminent stock market crash around the corner", or "$120 billion wiped off markets" in order to grab eye-balls.

But if we can zoom out and look at shares with a long-term lens we see that a lot of the risk disappears.

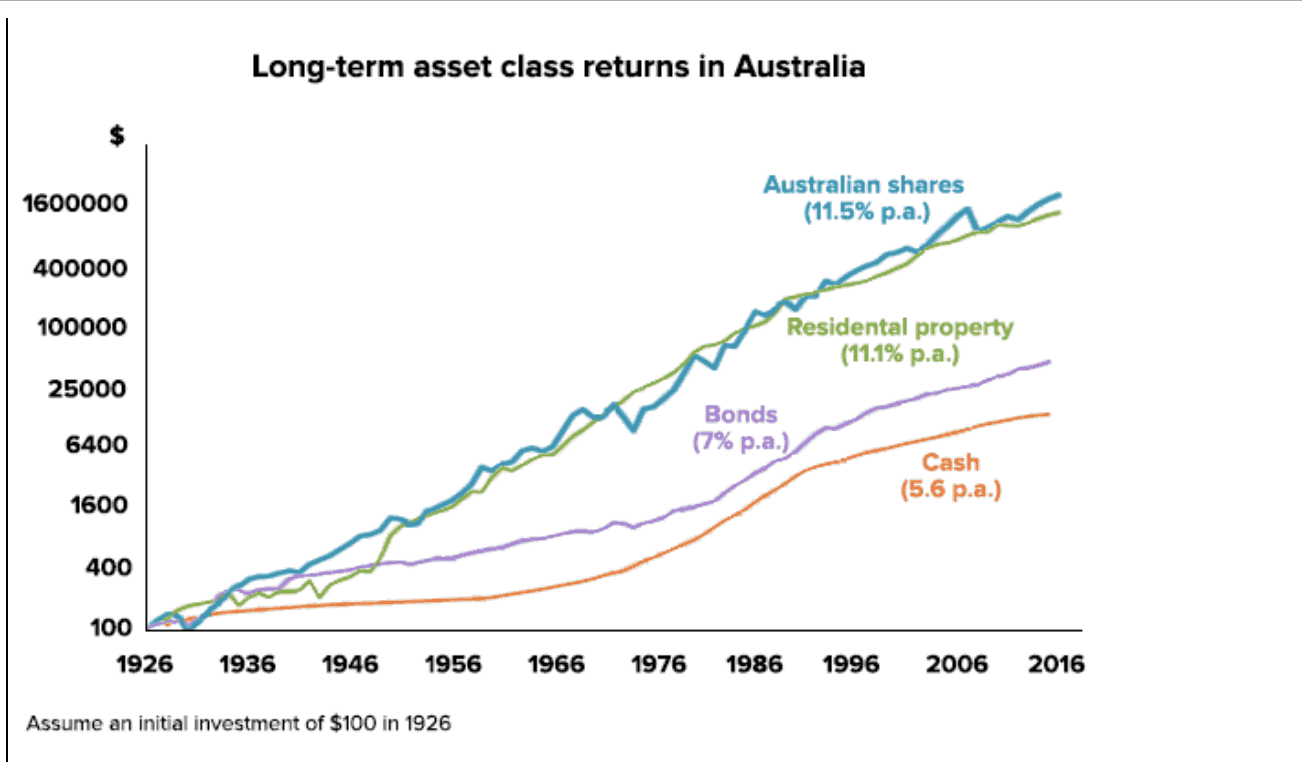

Sources: ABS, REIA, Global Financial Data, AMP Capital

As you can see, although there are short-term periods of poor performance by shares, if you can stay calm during these times and ride it out, then you will be handsomely rewarded with an 11.5% p.a. return.

Now if we look at the meaning of the word risk, then yes in financial theory it means variability of returns.

But what if you take a more literal meaning of the word risk, and look at the risk of not investing your money in an asset class other than cash?

A $100 investment in cash over 100 years (yes, this is an unrealistic timeframe I know, but it still illustrates the point) would have turned into approximately $10,000.

The same $100 investment over the same time period in either shares or real estate would have turned into $1.6 million. By taking the literal meaning of risk, clearly the choice to have your money sit in the bank, hoping you magically get rich is a hell of a lot more risky than investing in shares for the long-term.

And that is if you were to do absolutely nothing but buy and hold. If you were really smart and could hold your nerve during one of the many periods of short-term underperformance, you could even buy more shares when they are "cheap" and boost your total return even more.

For example imagine if you had been an intelligent investor who kept his head during the depth of the GFC and bought blue-chip companies like Commonwealth Bank of Australia (ASX: CBA), CSL Limited (ASX: CSL), and Ramsay Health Care Limited Fuly Paid Ord. Shrs (ASX: RHC) while they were selling at knock-down prices.

Source: Commsec

As you can see in the chart above, you could have bought shares in CBA for $23.90 in the depth of the GFC compared to $60 a year ago. Buying shares when they are undervalued can significantly increase your returns on top of the 11.5% p.a. long-term returns already available in the share market.

Foolish takeaway

To answer the original question, no, I do not believe investing in shares is risky. This is a common and understandable misconception of people who do not understand the nature of financial markets. However, if you take the time to understand what ownership of shares actually means, and realise that it is a long-term investment, you soon see that the greater risk is the opportunity cost of having your money sitting in the bank doing nothing.