The Iluka Resources Limited (ASX: ILU) share price fell 6% to $9.94 today following release of the company's half year results. The falls came despite strong growth in revenues and profits. Here's what you need to know (all figures are in Australian dollars):

- Revenues rose 24% to $662 million

- Net profit after tax rose 255% to $126 million

- Earnings per share of 30 cents per share

- Free cash flow per share of 53.4 cents per share

- Interim dividend of 10 cents per share announced

- Outlook for focusing on project development and optimisation at Cataby, Jacinth-Ambrosia, and Sierra Rutile

So what?

It was a very strong half year for Iluka Resources, which reported a 47% increase in Zircon pricing compared to the first half of 2017. Rutile prices also rose an average of 20% to US$906 per tonne. Iluka also announced that it has implemented further price increases late in the second half of 2018, with rutile prices to rise another 14%, and zircon set to lift another $180/tonne, or approximately 12%.

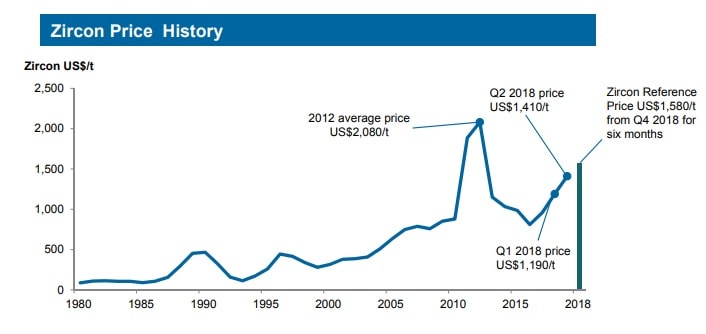

This chart from the company's slide pack shows that Zircon prices may be reaching their near term peak:

Iluka also confirmed initial signs of customers "thrifting" zircon (trying to use less material in production) due to the price increases, although there are reportedly no signs of "substitution" (replacing zircon with other materials) yet. It seems likely that a further price rise will only increase thrifting and the risk of substitution and that may start to put a lid on any further price increases that may be achieved.

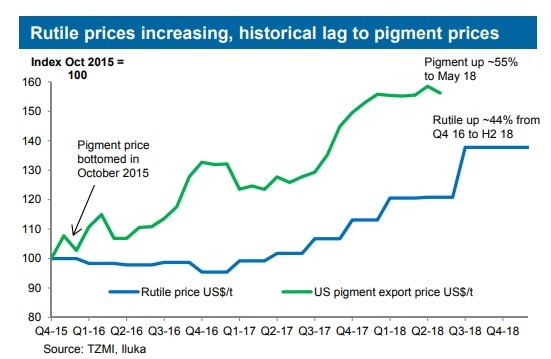

Trends in the rutile market however suggest that rutile prices may have some way to run:

Zircon and rutile are Iluka's two largest products, so improving pricing here bodes well for the company's earnings in future periods. All else being equal it is likely that Iluka has a stronger second half, or a stronger 2019, due to price increases.

Now what?

As one of the larger zircon and rutile miners in the world, Iluka is also investing heavily in expanding, with expansion projects at Sierra rutile and a new synthetic rutile project at Cataby in Western Australia that will begin production in 2019.

Iluka is also examining ways to smooth the production profile at its Jacinth-Ambrosia zircon mine, which has declining grades, and may require reinvestment of $60 million or more.

While pricing definitely appears to be improving, it is also notable that Iluka is in a position to increase its supply into the market via its expansion projects.

I would expect that other miners in a similar position are also exploring ways to increase their production. This is how mining cycles work – high prices lead to increased production which eventually leads to lower prices.

So while Iluka's near term future does look bright, were I to invest here I would look at how much extra supply will be coming online over the next few years, before making a purchase.