In early trade the Pro Medicus Limited (ASX: PME) share price pushed 4.5% higher to an all-time high of $9.09 following the release of the imaging IT provider's full year results.

For the 12 months ended June 30 2018, Pro Medicus posted a 13.9% increase in revenue to $36 million and a 36.7% jump in profit after tax to $12.7 million. Underlying profit, excluding currency movements, was up 27.4% to $12.6 million.

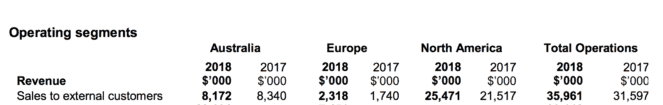

As shown below, the main driver of this growth was the positive performance of its North American and European operations. Revenue in these segments increased 18.4% and 33.2%, respectively, in FY 2018. This made up for a soft performance from its Australian operation.

The North American segment was given a boost from the signing of three key contracts. This included an A$18 million, seven-year contract with Yale New Haven Health, one of the leading academic institutions and a A$15 million, seven-year contract with Mercy Health for Visage Open Archive.

Pro Medicus' strong bottom line growth was largely down to its North American business. CEO Sam Hupert stated that: "The key driver for margin and revenue growth was our North American business. We brought more sites online so had a good year in terms of professional services, which includes implementation and training. Those sites that were online continued to build their transaction volumes which is pretty much what we expected, so we're very pleased with that."

Before adding that: "Looking at margins, we've always said that the US is a higher margin business and therefore the greater the contribution from the US the higher the margins in total. As we grow this business and build our base of recurring transaction revenues in that market we should see further margin expansion."

This ultimately led to earnings per share of 12.2 cents, up from 9 cents per share in FY 2017. And with the company remaining debt-free and seeing its cash reserves rise 10.8% to $25.2 million, the board was able to increase its full-year dividend by 50% to a fully franked 6 cents per share.

Should you invest?

As I mentioned yesterday, I think Pro Medicus is up there with Nanosonics Ltd (ASX: NAN) and Volpara Health Technologies Ltd (ASX: VHT) as one of the best medical technology shares on the Australian share market.

There's no denying that its shares are expensive at 75x earnings and carry a lot of risk, but I remain confident that it can grow at a level that justifies this premium over the long-term.