Shares in Amcor Limited (ASX: AMC) have fallen nearly 8% from $15.28 to $14.16 today after the packaging giant returned to the ASX boards from a trading halt imposed on news it is to acquire U.S. rival Bemis Inc for an upfront 25% premium.

Amcor will offer 5.1 shares for every 1 Bemis share with shareholders owning 71% and 29% respectively of the combined company.

However, it seems Amcor shares got ahead of themselves in the week prior to the news becoming official, with Bemis shares also spiking over the NYSE-trading-day prior to the deal's announcement.

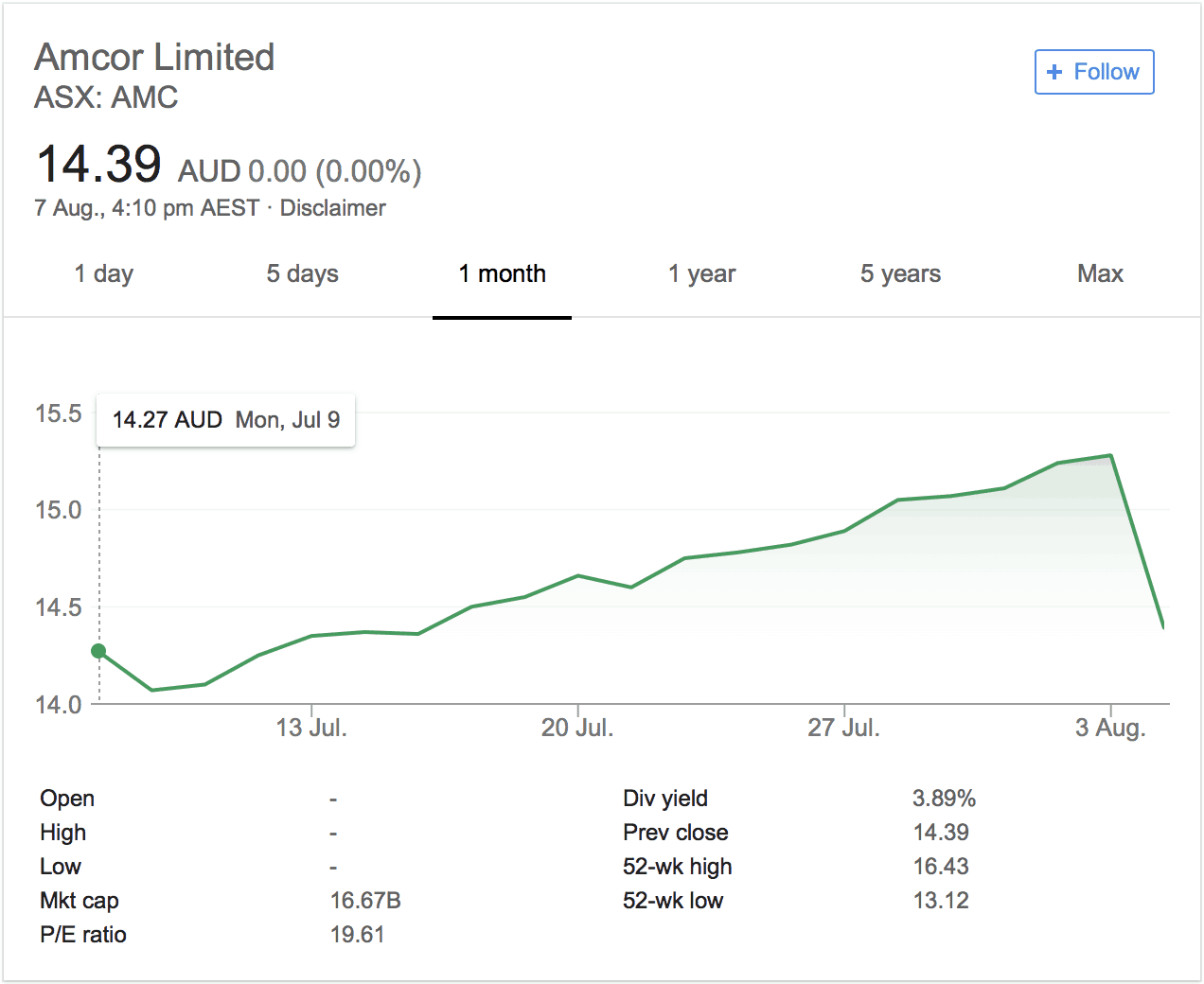

Speculators who got wind of the giant US$6.8 billion deal and hoped to make a cheeky profit may even be underwater looking at the below chart.

Chart: Amcor share price over past 1 month (Source Google Finance).

While some investors would consider coal miners like Whitehaven Coal Ltd (ASX: WHC) or pokie machine manufacturers like Aristocrat Leisure Limited (ASX: ALL) as among Australia's least ethical companies due to their downstream impact on society, it's fair to say Amcor's place as a leading manufacturer of cigarette packets makes it a strong contender on the unethical front.

The combined Amcor Bemis group will have pro forma EBITDA of US$2.2 billion on revenues of US$13 billion and expects to be able to make pre-tax cost savings of US$180 million per year by year three as a result of the deal.

The move to de-list from the ASX should come as no surprise to Amcor investors given it already reports in U.S. dollar with the majority of its operations overseas.

If Amcor's ethics aren't your cup of tea, why not read on about a company growing like nuts while providing innovative healthcare services….