BWP Trust (ASX: BWP) released its annual report for 2018 this morning with numbers more or less consistent with last year.

Here's what you need to know:

- Revenue was up marginally by 1% to $153 million

- Profit before gains on investment properties were also up marginally by 1% to $113 million

- Distributions rose 2% to 17.81 cents per unit

- The portfolio is 99.9% leased

- Weighted Average Lease Expiry of 4.5 years at 30 June 2018

- Gearing of 19.3%, average time to debt maturity of 2.2 years

- Net tangible assets (NTA) of $2.85 per unit

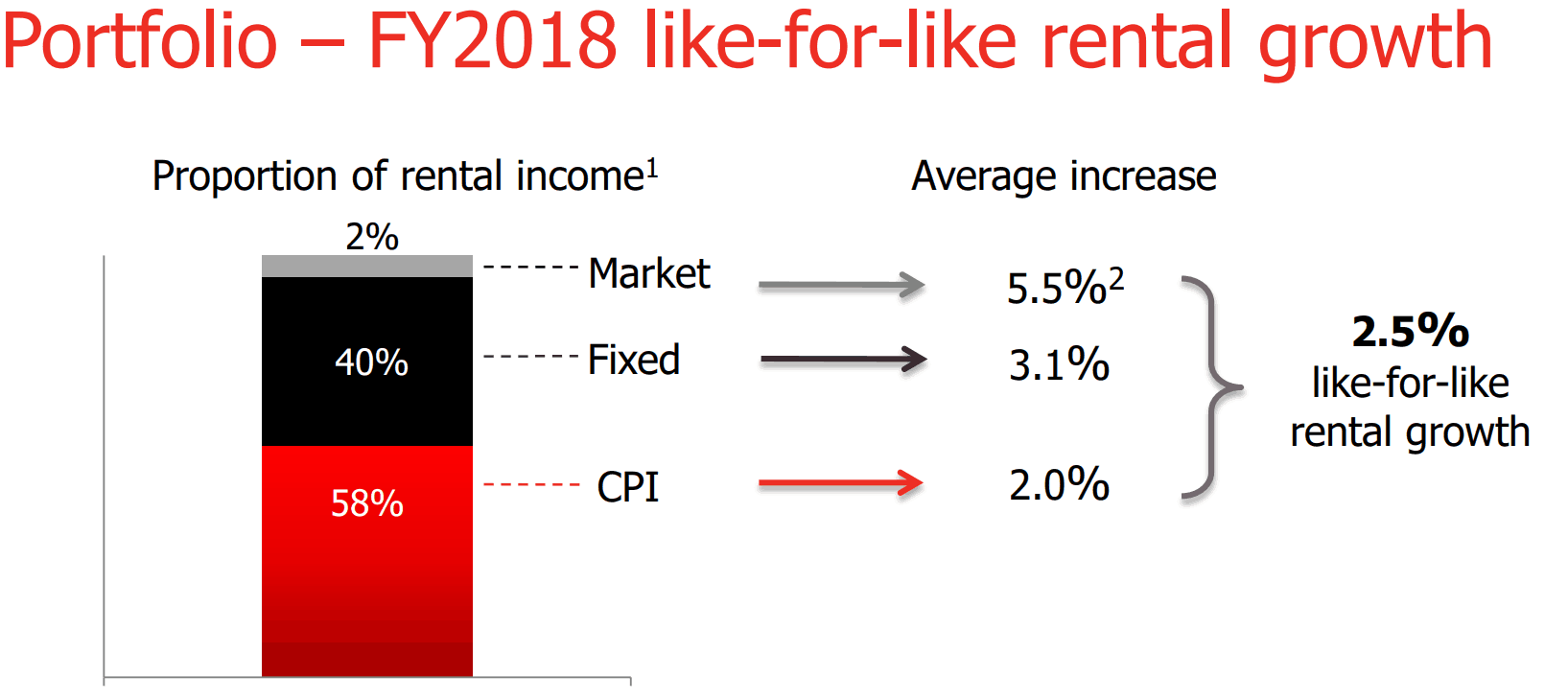

- The portfolio had a 2.5% like for like rental growth

Why the modest growth?

As the chart below shows, 58% of of the Trust's rental income is subject to CPI related annual increases, while 40% of its rental income is subject to fixed increases of 3.1%. Only 2% of the income is subject to market related increases (currently at 5%).

With CPI currently only at 2%, it means the majority of the portfolio has experienced marginal growth.

Source: BWP Trust investor presentation

Outlook

Besides the rental increases, going forward BWP Trust will rely on the strength of the overall home improvement retail market for performance given that its core tenant is Bunnings Warehouse – owned by Wesfarmers Ltd (ASX: WES).

While the quality of the tenant and the high occupancy rate provide some stability, low growth in income and ultimately distributions is something to keep an eye out on.

This is particularly important as the Trust announced that in FY 2019 it may be transitioning up to nine Bunnings Warehouse stores to alternative uses which may result in rent free periods and capital expenditure.

BWP Trust's share price has gone up 12% over the last year but with distributions staying the same, its dividend yield has effectively dropped to 5.4%.

With its shares trading at $3.31 per unit at the close of trading yesterday, BWP is also priced at a premium to its net tangible assets (NTA) of $2.85 per unit.

As a result, there is a risk that BWP might underperform in the short term, but the quality of its portfolio might interest longer term investors.

Looking for more income ideas?

If you like BWP Trust for its high income you will not want to miss this FREE REPORT by our team of experts which identifies some top dividend paying shares.