Over six months ago I called Think Childcare Ltd (ASX:TNK) a founder-led small-cap I would buy.

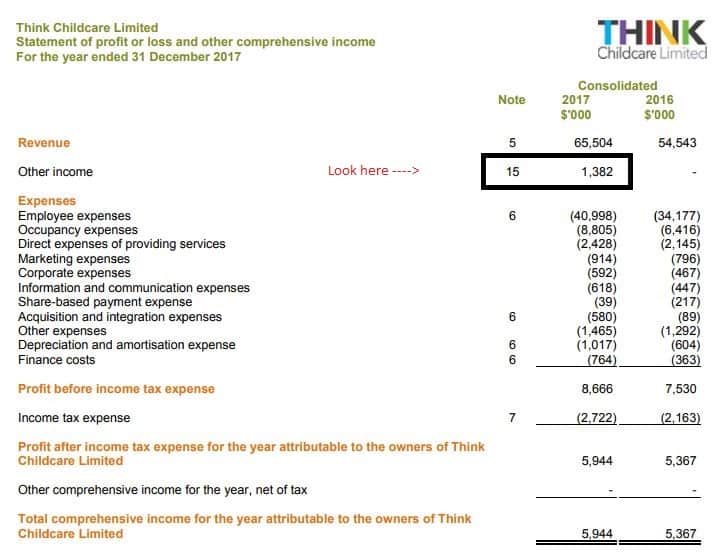

However, I was subsequently disappointed by the half-year results in August, and the guidance therein. Specifically, the positive impact on earnings of the "earn-out not paid", disclosed in the half year report, made the statutory results look better than the underlying results. As you can see below, the full year profit would have been lower if not for the $1.382 million in "other income". That "other income" is actually a result of an under-performing acquisition, so it's not a good thing!

Back in August, I wasn't able to get in touch with the CEO to discuss this issue. However, I was able to get in touch with Paul Gwilym, the CFO, who answered my questions well.

We have recently discovered that Paul "will retire as Director and Company Secretary at the Company's 2018 Annual General Meeting (AGM) in May, and will cease in the role as CFO on 13 April 2018." Furthermore, the company announced a capital raising at a price of $1.99, in part to fund more acquisitions. Given the track record of prior acquisitions, I do not find this particularly exciting for shareholders.

Overall, my opinion on this company has changed — I was wrong (sorry!). The departure of Paul Gwilym, who owned well over $1 million worth of shares at the end of 2017, has prompted me to comment that I would not hold shares in this company.

I'd be more interested in this company.