There's nothing sexy about waste management, but shareholders of Bingo Industries Ltd (ASX: BIN) certainly won't care about that.

Since hitting the ASX boards in May of last year at a listing price of $1.80, Bingo Industries' shares have risen a sizeable 41%.

It isn't hard to see why investors have been fighting to get hold of the company's shares in my opinion.

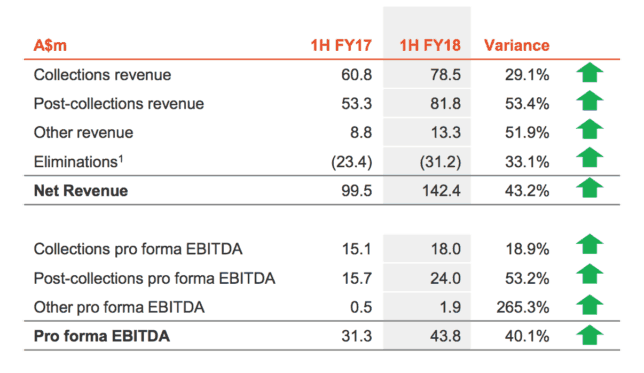

Earlier this week the company released its half-year results which revealed revenues of $141.7 million and pro forma net profit after tax of $21.3 million. This was a 43.2% and 37.1% increase, respectively, on the prior corresponding period.

As you can see below, there was growth across the entire business during the half.

Sales growth in the Collections segment was driven primarily by an increase in market share in NSW. By the end of the half the segment had a fleet of 253 trucks, compared to 173 a year earlier. Post-collections revenue increased by a massive 53.4% during the period thanks also to an increased market share in NSW.

As you might have noticed higher up, profits grew strongly during the period, but a touch slower than revenue. This was due to a slight reduction in margins as a result of the inclusion of acquired Victorian businesses and higher operating costs to support its national expansion.

Bingo expanded into the Victorian market through the acquisitions of Konstruct, AAZ, and RRV in October 2017. While these businesses are expected to weigh on margins a little initially, management appears confident that they will rise in line with the rest of the business eventually.

With this positive momentum expected to carry over into the second-half, I believe Bingo Industries is in a position to at least achieve its upgraded FY 2018 pro forma EBITDA guidance of approximately $93 million. This represents year-on-year growth of 45%.

Why invest now?

Although its shares are up significantly since landing on the ASX, they still only change hands at approximately 20x estimated forward earnings. I think this is good value for a company with defensive qualities (trash always needs to be collected) and strong growth prospects.

Speaking of which, in the short-term Bingo has a lot of work in hand and a growing pipeline of contract opportunities according to management. And in the long-term the company aims to expand its footprint nationally by 2021.

In addition to this, its shares are trading at a discount to industry peer Cleanaway Waste Management Ltd (ASX: CWY), which is priced at 27x estimated FY 2018 earnings.

Overall, I think this makes it a great time to consider Bingo as a long-term buy and hold investment.