With a number of recent, highly publicised hacks of government and commercial agencies worldwide, many investors are wondering how they can get increasing exposure to an industry – cybersecurity – that seems set for a boom.

In Australia, our choices are limited, but one possibility is the BETASHARES GLOBAL CYBERSECURITY ETF (ASX: HACK), which offers exposure to a global portfolio of cybersecurity companies at a modest cost.

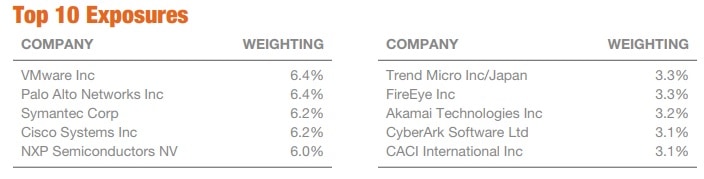

While purportedly global, the HACK exchange traded fund (ETF) is heavily US-focused, with 73% of its portfolio allocated to this country. Its top 10 companies by exposure are:

This ETF has only been around since August 2016, but it has returned 14% after fees since then, reflecting both strong growth in the underlying companies as well as a boom in US share prices.

Betashares charges a 0.67% fee to administrate the HACK ETF each year, which comes out of the assets it holds, you don't have to pay extra for it. However, if you are investing in this ETF, or any ETF, via your superannuation fund or SMSF, it's important to consider the impact of paying 'fees on fees' – paying one fee for the ETF, and a second fee on top for your super fund.

What's the point of the HACK ETF?

It gives good exposure to a group of cybersecurity and technology companies that are growing at a rapid rate. It provides more specific exposure to a niche of the market that could otherwise be difficult to access, without opening a brokerage account that can trade US stocks.

However, as an ETF, HACK will generate returns that are a weighted average of all the companies it holds. For example if VMware Inc, one of HACK's largest holdings, was to severely underperform, it would have a much greater impact than if CACI International Inc greatly outperformed.

In general this means that the ETF will perform worse than the best of the companies it holds, and better than the worst of the companies it holds – both before fees.

Another important consideration are the elevated share prices in the USA. The market looks expensive, although many of the companies in the HACK ETF have market power or a competitive advantage, arguably justifying a higher price.

If I were buying the HACK ETF, I'd look to split my purchase in 2 or 3 pieces, spaced out , in order to get a better overall buy price.

As it is though, the HACK ETF looks like a hassle-free and low-cost way to achieve extra diversification, and I think it's worth a closer look from investors.