Not even Santa could tell you where the Australian Dollar (A$) (AUDUSD) to US Dollar ($) (USD) exchange rate is going to be by Christmas, but here's how you can prepare for anything.

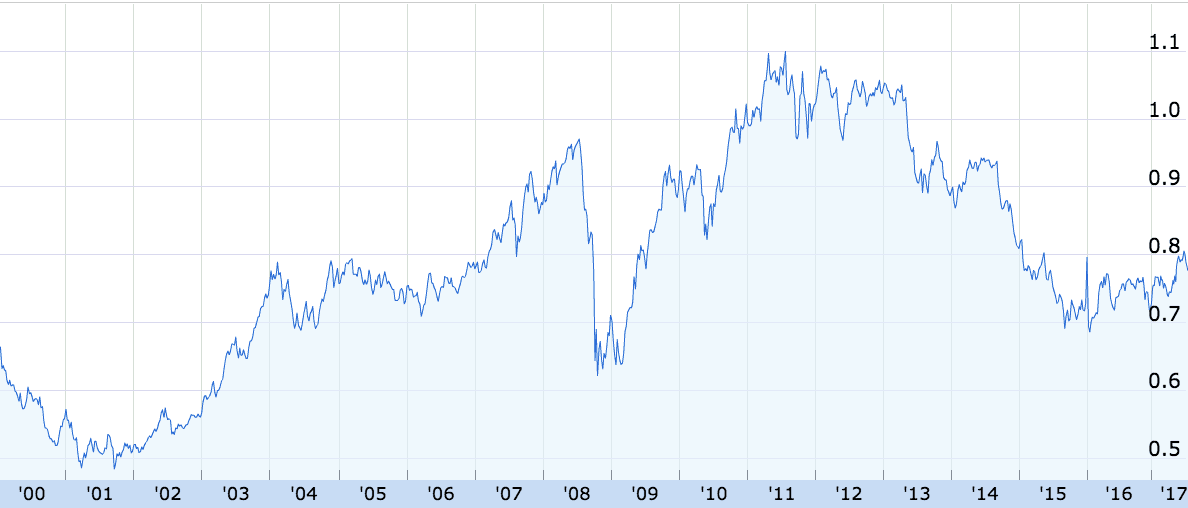

AUD to USD

As can be seen above, following a hefty decline in the Aussie dollar between 2011 and 2016, the dollar has risen modestly over the past 18 months.

I'll be the first to admit that the rise in the AUD caught me off guard. Then again, the rise in iron ore prices and the RBA's about-turn on its Australian economic outlook caught traders by surprise, too.

Heck, even expert economists were predicting more interest rate cuts in 2017, which would have kept downward pressure on the Australian dollar. That didn't happen either.

Nevertheless, once again some experts are predicting a decline in the Aussie dollar.

Some of the reasons why experts are forecasting a lower Aussie dollar include:

- Rising US interest rates

- Falls in commodity prices, like iron ore and coal

- US tax reform

- Slower economic growth in Australia

Obviously, pundits have been predicting such things for many years.

Does it matter?

Aside from the Australian dollar being very difficult to predict (it's near impossible in the short term, if you ask me), ask yourself: does it really matter?

Unless you're in the business of importing or exporting goods you needn't be overly concerned.

Australian investors shouldn't be too concerned, either, since you should be investing a meaningful part of your wealth overseas regardless of the Aussie dollar.

For example, if you have most of your wealth tied up in Aussie property and bank stocks, you are increasing your risk and potentially foregoing better opportunities internationally.

A solution

In the first instance, you could try investing in companies which are listed on the ASX but do business overseas. Companies like CSL Limited (ASX: CSL), Australia's biggest and best healthcare company, or Janus Henderson (ASX: JHG), the leading global fund manager, conduct a big chunk of business outside Australia.

Ideally, you should be actively investing directly on overseas markets through a brokerage account or via managed funds. You can open a US dollar brokerage account within minutes to access the NYSE or NASDAQ exchanges, for example.

More than 98% of the world's investment opportunities can be found overseas.

Foolish Takeaway

Rather than fretting over the direction of the Australian dollar and going 'all in', you could simply average your currency transactions by contributing money to an international brokerage account on regular basis. In my opinion, it makes sense to have more money invested abroad than locally on the ASX.