Across the country many investors, especially those just starting out, make a simple mistake that can mean their valuation of a company is way off.

That is, they get the number of shares on issue wrong. And that means they calculate market capitalisation incorrectly.

Allow me to explain.

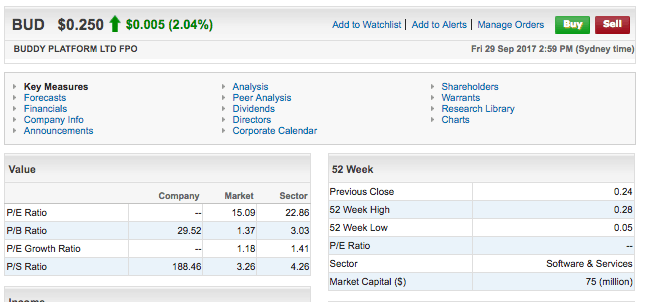

If you use CommSec (or other data providers) to ascertain the market capitalisation of a company like Buddy Platform Ltd (ASX:BUD) you will see it is $75 million.

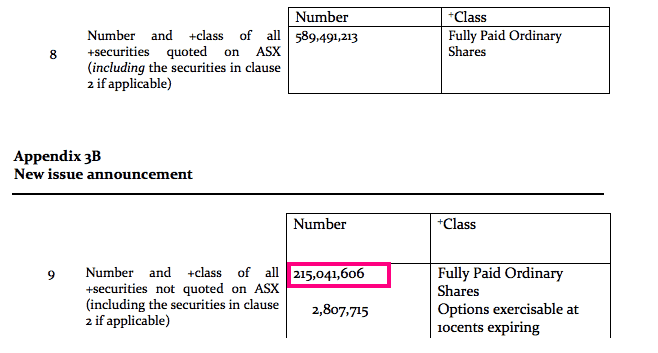

However, if you look at the company's most recent Appendix 3B you can see that it has over 200 million shares not quoted on the ASX.

Therefore, there are 589 million quoted shares, and 215 unquoted shares. This gives a total of 804 million shares, and a market capitalisation of a bit over $200 million at the current share price.

Now Buddy CEO Dave McLauchlan is on record saying it is up to analysts to calculate market capitalisation based on tradeable shares, if they want (Note: wording changed slightly). The normal thing is for ASX companies to report market capitalisation as the total number of shares on issue (you can see this in many presentations). However, even using Dave McLauchlan's second alternative definition of market capitalisation as "tradeable shares", the Commsec market capitalisation is still wrong. There are 589 million listed shares that are tradeable, so the tradeable market capitalisation of Buddy Platform is $147 million.

There are countless other companies that have an incorrect market cap displayed by Commsec or other providers. Many companies make it very clear what their actual market capitalisation is in their company presentations. However, investors should always double check the market capitalisation of a company with the actual documentation, since you cannot rely on the data provided automatically by data providers.

One popular company that has a lot of unquoted shares is Getswift Limited (ASX:GSW). Commsec states it has a market capitalisation of $195 million, but with over 150 million shares on issue, its market capitalisation is actually over $375 million.

The good news is that more established, profitable, dividend paying companies usually do have the right market capitalisation from data providers, so this issue is mostly a concern for people who invest in higher risk, recently listed, small-cap stocks.