At $74, Commonwealth Bank of Australia (ASX: CBA) shares may be getting closer to a buy.

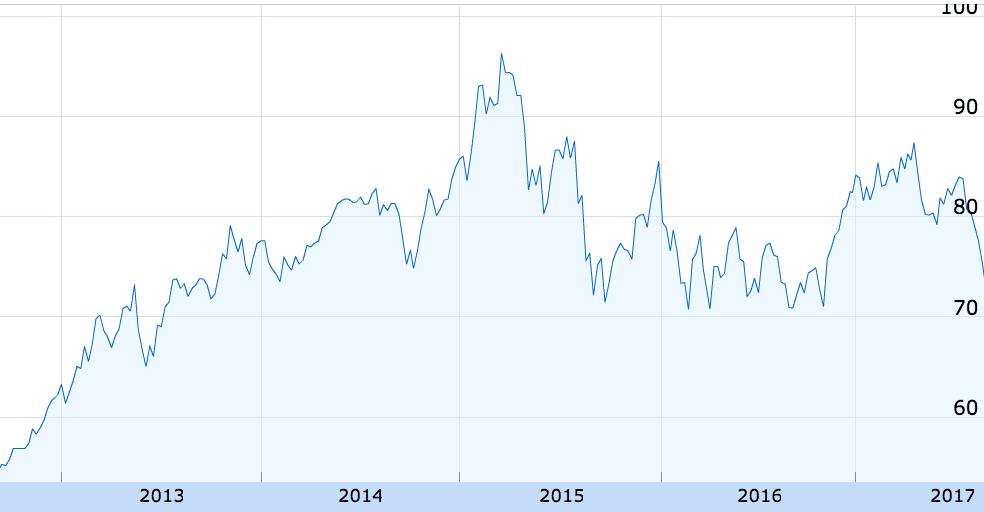

CBA share price

As can be seen above, CBA shares have been on a downwards trajectory in recent times.

Ever since news of the banking giant's potential money laundering fines surfaced, investors have been on the back foot.

In just one month CBA shares have fallen 8%. That compares to National Australia Bank Ltd.'s (ASX: NAB) share price rise of 1.3%.

Are CBA shares a buy at $74?

With the economy and the broader Australian share market, or S&P/ASX 200 (Index: ^AXJO) (ASX: XJO), continuing to hold firm in 2017, the recent dip in CBA's share price should have a few investors interested.

However, it seems analysts have been scared off along with the crowds. According to The Wall Street Journal, only one of 15 analysts surveyed were bullish on the banking giant's shares.

Just three months ago, four analysts were positive on CBA.

At today's prices, CBA shares are forecast to pay yearly dividends of 5.9% — fully franked — and trade at a price-earnings ratio which is below the market's average. That's a far cry from its valuation in 2015 when punters were betting CBA would be the next $100 stock.

However, as always it is important to understand the difference between price and value. While CBA's share price may have retreated in recent times, I believe its valuation has also fallen slightly.

In addition to potential fines from the courts, some structural tailwinds are slowing (think: house prices peaking, interest rates bottoming, bad debts, etc.). Therefore, it may pay to be cautiously optimistic and wait on the sidelines for a better price.

Foolish Takeaway

In my opinion, investors should have CBA shares on their watchlist because if it continues to fall through $70 it could be an opportunity. I have previously stated that Australia's largest bank would need to fall below that point to be a compelling investment opportunity.

Until then, CBA shares remain on my watchlist.