The Freedom Foods Group Ltd (ASX: FNP) share price jumped 6% to $4.68 after it released its annual report late this afternoon. I was expecting the worst, it's usually a bad sign when a company sneaks its annual report out 20 minutes before market close on the last day of August.

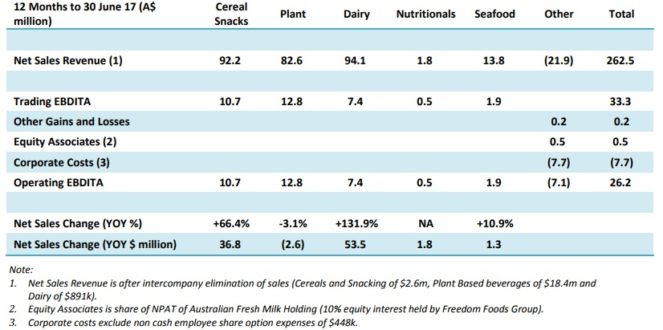

Results were strong however, and comparable sales revenues jumped 54% to $262 million, while operating earnings before depreciation, interest, tax, and amortisation (EBDITA) rose 22% to $26.2 million. Statutory net profit after tax (NPAT) was $7.5 million, impacted by one-off costs due to restructuring and acquisition costs. On an operating basis, operating profit fell 9% to $9.9 million due to higher depreciation and finance costs. Earnings per share were 4.78 cents on a statutory basis and dividends were 3.6 cents per share.

Freedom Foods is investing heavily in expansion, and part of the weak statutory result was blamed on downtime due to major processing upgrades. Freedom has spent $130 million on upgrades this year, including the construction of a new milk processing factory, which is expected to become a major contributor to earnings over time. Already, Freedom Foods draws a significant part of its sales from dairy:

Management continues to forecast significant future growth in parts of the business, including the plant-based milks and oat segments. New product launches that were delayed in financial year 2017 due to retailer schedules are expected to contribute meaningfully in 2018. Growth in China also represents an interesting opportunity, especially with the company's recent milk facility upgrade and addition of a PET bottling capability.

The outlook for 2018 is bright as a result, with management forecasting sales of between $340 million and $360 million, which would indicate around 29% to 37% revenue growth in the coming year. Profit margins are also expected to improve, which could see a disproportionately large increase in next year's profits. Of course, Freedom Foods' expansions this year lay the groundwork for the business to grow consistently in the future, not just for one year. Still, the company comes with quite a price tag and in my opinion, investors will have to think carefully about whether it can measure up.