The Automotive Holdings Group Ltd (ASX: AHG) share price fell 1% this morning after the company released its annual results. Here's what you need to know:

- Revenue grew 8% to $6,080 million

- Net profit after tax (NPAT) fell 38% to $55 million

- Operating NPAT fell 10% to $87 million

- Operating earnings per share (EPS) of 26.7 cents

- Dividends of 19 cents per share

- Net debt of $986 million ($711 million is for new car finance)

- Outlook for a modest improvement in operating performance in 2018

- Focus on free cash flow + reduced capital expenditure

- National rollout of easyauto123 + continued growth in refrigerated logistics

So what?

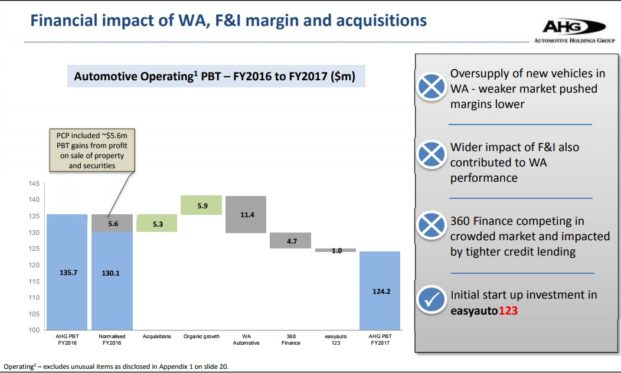

It was a tough year for Automotive Holdings, which saw its profit hit by $32 million in unusual items due to the restructuring of operations and write-downs in business value. If these expenses are excluded, operating NPAT still fell 10% due to higher competition in the vehicle finance and Western Australia vehicle market.

New vehicle sales in WA have fallen 22% since their peak in 2012, although Automotive Holdings has benefited by growing its market share, up from 18% to 24% over the past 5 years. With the company's strong financial position and expanding footprint, it could be a big winner if activity picks up again.

Now what?

Management has forecast improved operations in 2018, and the business is expected to generate significantly more free cash flow as capital expenditure will reduce. With the restructuring of the refrigerated sector including a variety of cost savings, this business should perform much better in the coming year. One thing to keep in mind is that Automotive Holdings is vulnerable to a decline in the number of new cars sold, as we saw earlier this year. A relatively small decline in car sales can lead to a substantial fall in profits. However, the company is well funded, has a strong competitive position with its dealerships Australia-wide, and has implemented several strategies that could lead to further growth in the future.

For investors that know they can take a long-term, 'through the cycle' look at car sales, Automotive Holdings could be worth a closer look today.