The Aconex Ltd (ASX: ACX) share price fell 6% to $4.32 after the company released its annual results this morning. Here's what you need to know:

- Revenue jumped 31% to $161 million

- Excluding Conject acquisition, revenue rose 16% to $133 million

- EBITDA from core operations rose 10% to $15 million

- Cash flow positive at an operating level

- Cash at bank of $33 million

So what?

Construction software company Aconex made progress towards its goals this year. Revenue rose and the company continues to generate cash from its operations, which should reduce the likelihood of the business requiring a capital raising in the future.

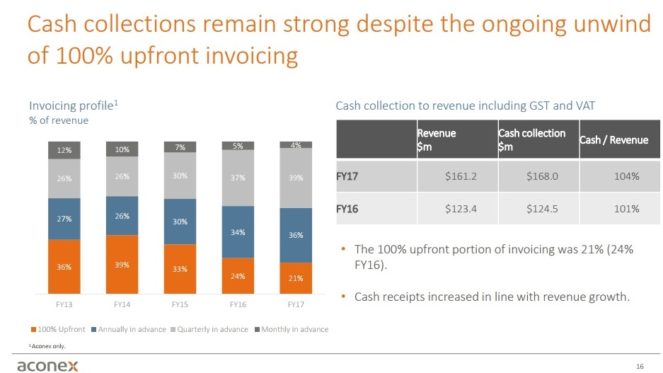

That said, Aconex also continues to switch from a 100% cash up front invoice model to a combination of quarterly and/or annually in advance. This may place more pressure on the company's cash flows as the unwind continues:

Over time this should lead to better alignment between cash flow and expenses, but there may be some additional lumpiness of revenues in the short term. If Aconex had not received 104% of its revenues as cash, the company would have gone backwards from a cash flow perspective. Fortunately, Aconex still has $33 million in cash to absorb some disruption here in the future.

Now what?

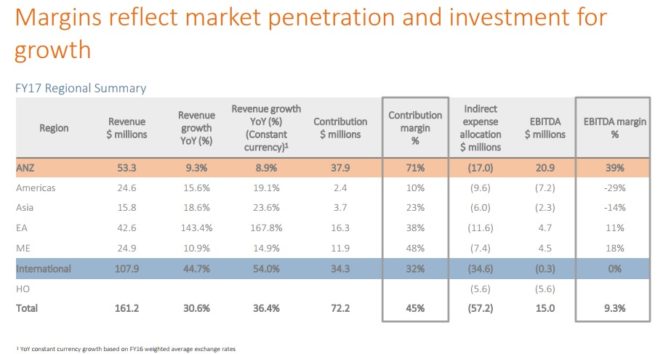

While cash is an important issue for Aconex, especially if it needs to invest further in development or marketing, revenues are equally important. Here the company is growing strongly, with management forecasting 15% to 19% revenue growth in 2018 and 20% revenue growth over the medium to long term. If Aconex can continue to grow its revenues, its earnings before interest, tax, depreciation and amortisation (EBITDA) margins in the international segments should widen substantially, making the business a lot more profitable:

While Aconex does carry a lofty price tag, it also is the type of company that could go on to justify it. I have previously written my scepticism of the business' valuation on several occasions, but results this year look to be moving in the right direction and I will likely be having a closer look at Aconex in the near future.