Tax loss selling arises because capital losses can be used to offset capital gains.

If, for example, I had crystallised a capital gain of $2,000 by selling my shares in Magical Milk Powders (ASX: MILK) I might have to pay capital gains tax on that profit. However, I might also hold shares in Elite Sport Gizmos (ASX: GIZM) that are showing a $2,000 paper loss.

Facing such a scenario, some investors might be tempted to sell their shares in Elite Sport Gizmos, simply to crystallise that loss. This would act to offset the capital gain they made on Magical Milk Powders earlier in the financial year, thus allowing them to reduce their tax bill. Many would consider that a win.

Now, I am not advocating tax loss selling. I am advocating tax loss buying, because it has paid off for me and my members, in the past. Let me give you two real life examples.

On June 30 2014, I stated my intention to buy Kip McGrath Education Centres Limited (ASX:KME) shares from a motivated seller at around 20 cents. I executed on that plan (at 20.5 cents) and was rewarded with a near 50 per cent gain in a just a few days. You can see how the share price spiked down on June 30, in the chart below. I hold Kip McGrath shares and am pleased with recent performance.

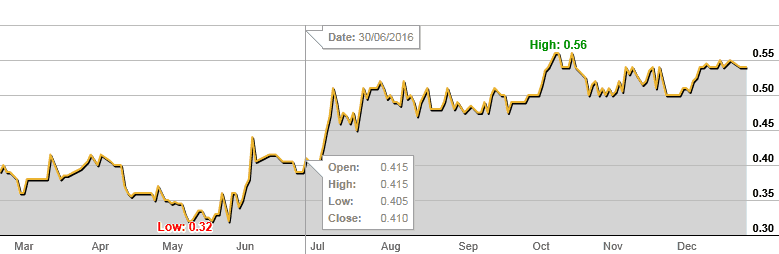

Another time we spotted that a decent little software company was trading at low prices, despite the fact it looked like it was improving its business (which, admittedly, had struggled.) That is the kind of situation where you often find motivated selling prior to the end of the financial year. So Scott Phillips and I recommended it to Motley Fool Hidden Gems members on the morning of June 30, 2016, in the hope of finding adequate volume at a good price. The method may not have worked as well as it did with Kip McGrath, but it appears to have been a good buy, to this day. We still recommend the company in question and I'm pleased with recent performance.

Tax loss buying is an interesting technique, and I certainly recommend looking into it. However, the draw back is that the chance to do it only comes around once a year. If you're looking for a worthwhile buy today, I suggest you check out these 3 stocks, which come highly recommended by my friend and colleague.