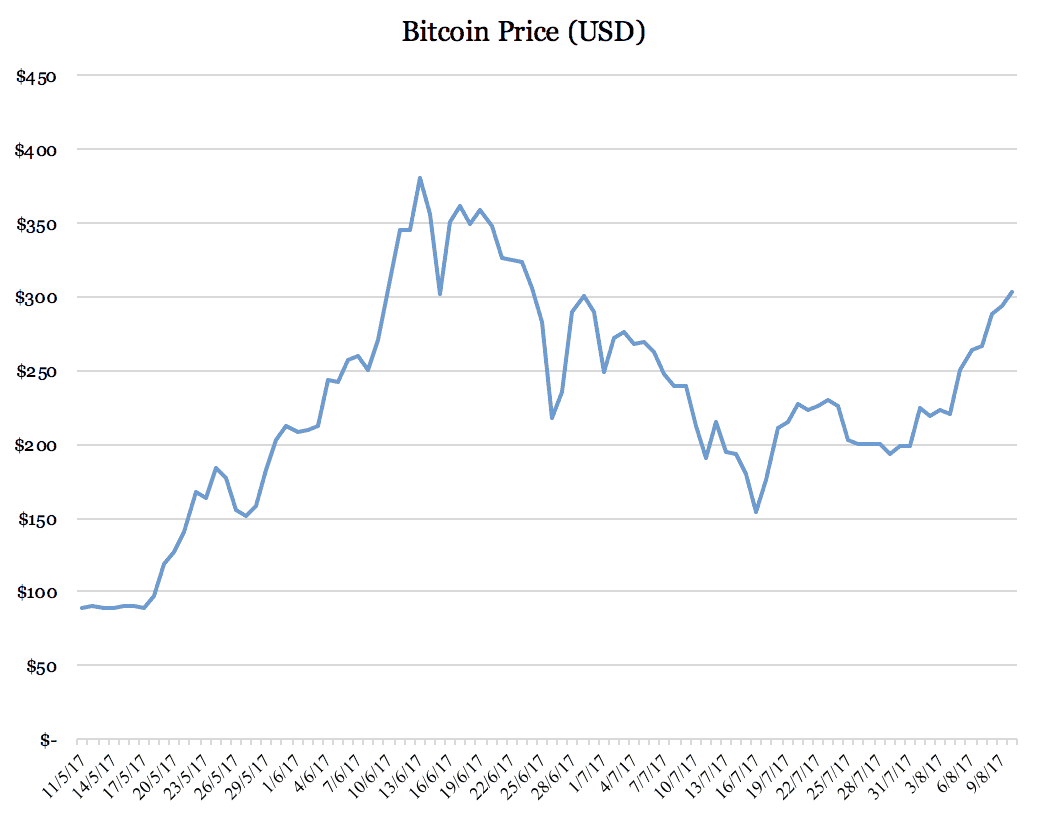

The Bitcoin price went in the opposite direction to what I thought it would.

Bitcoin Price Chart

At the end of July, I wrote: "I think the Bitcoin price is going to crash". Boy, was I wrong about that one…

August 1, 2017, was supposed to be the day that the Bitcoin backbone (read: blockchain) was due for a change or two.

It changed alright. We now have Bitcoin Cash and regular Bitcoin.

What's the difference between Bitcoin Cash and Bitcoin?

Bitcoin Cash is priced differently — currently $275, according to coinmarketcap — but it is a much more efficient system. It can handle many more 'transactions' than the regular Bitcoin network. That was the original purpose of the Bitcoin currency — that is, to be an actual currency.

Unfortunately, not every Bitcoin exchange deals in Bitcoin Cash.

And like the other 800+ digital currencies available on the market, its success will depend entirely on the demand from other people in the market.

So at the moment, it appears that Bitcoin and Bitcoin Cash are still stuck in the realm of pure speculation.

Foolish Takeaway

Ethereum, Ripple, Bitcoin; they are only worth what someone else is willing to pay for them because they produce no income or cash whatsoever for their owners. See the 'Greater Fool Theory'.

They are unlike businesses (shares) and property, which earn a reliable income stream for their owners and create economic value.

So although I may have been wrong about the Bitcoin price dropping on August 1st, I am still staying well clear of Bitcoin and all cryptocurrencies for now.