Berkshire Hathaway (NYSE: BRK-A ) (NYSE: BRK-B ) has a number of things going for it if you're considering an investment in it, but dividend income certainly isn't one of them. Warren Buffett's company doesn't pay out a single dime to its investors in the form of dividends — and 2014 isn't likely to change that trend.

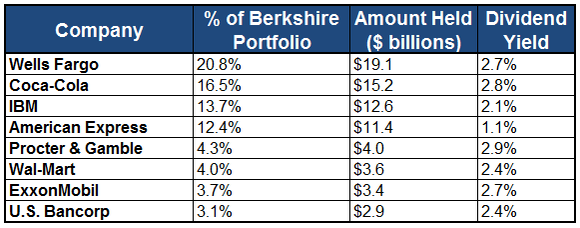

This all comes as a bit of a surprise when you consider that of its top eight investments, all of them pay out a dividend, and in fact many of them are among the better-known favorites among dividend investors:

Source: Company SEC filings.

Two of Berkshire's most recent and notable investments — IBM (NYSE: IBM ) and ExxonMobil (NYSE: XOM ) — have two of the highest dividend yields on the list. Berkshire also holds the exclusive $5 billion stake in Bank of America (NYSE: BAC) preferred shares that carry an annual dividend of 6%. If you take those eight investments, plus the Bank of America position, Berkshire rakes in roughly US$2 billion each year in the form of dividends from other companies.

As a result, many investors would like to know why Berkshire doesn't pay a dividend, and if it's poised to do so anytime in the future. Buffett addressed this very question in his most recent annual letter to shareholders:

A number of Berkshire shareholders — including some of my good friends — would like Berkshire to pay a cash dividend. It puzzles them that we relish the dividends we receive from most of the stocks that Berkshire owns, but pay out nothing ourselves.

Buffett went on to say that the value to shareholders increases if a company first considers reinvesting profits back into the business, and then thinks about possible acquisitions and finally share buybacks. After all three of those things have been exhausted, only then would Buffett advise a company to consider paying out a dividend. And Berkshire's actions in 2013 give us solid insight into what may happen to the dividend next year.

Reinvesting

Specifically, Buffett says that "a company's management should first examine reinvestment possibilities offered by its current business — projects to become more efficient, expand territorially, extend and improve product lines, or to otherwise widen the economic moat separating the company from its competitors."

When you consider that last year Berkshire had a record US$12.1 billion in "fixed-asset investments and bolt-on acquisitions," and year to date it has US$7.7 billion of cash dedicated to the purchase of property, plant, and equipment, relative to the US$7.2 billion through the first nine months of last year, it doesn't look as if Berkshire has taken any steps away from its dedication to reinvest back into its business.

Acquisitions

After extolling the value of reinvesting into a business, Buffett went on to say he thinks acquisitions unrelated to current businesses are the next best use of Berkshire's cash. "[O]ur test is simple," he said. "Do Charlie [Munger] and I think we can effect a transaction that is likely to leave our shareholders wealthier on a per-share basis than they were prior to the acquisition?"

Knowing that Buffett pulled out the "elephant gun" to acquire Heinz for US$28 billion with private equity firm 3G Capital earlier this year, it's evident that Buffett and his managers are not only reinvesting back into the business, but also actively looking for companies to acquire.

Repurchases

As a final point, Buffett said that "disciplined repurchases are the surest way to use funds intelligently," and he concluded that the company would actively considering repurchasing stock if the price traded for less than 120% of its book value. Buffett was been active on both the reinvesting and acquisition fronts, but the same can't be said for share buybacks, as the most recent SEC filing states simply, "There were no share repurchases in the first nine months of 2013."

Dividends

It's logical to think that since there haven't been any share repurchases, Buffett may be amenable to exploring a dividend. However, when you consider that through the first nine months of the year Berkshire has had cash flows from investing activities total US$25.5 billion, versus US$7.5 billion last year, it becomes evident that Buffett's philosophy on principally investing in his company first hasn't changed one bit, and the dividend yield of 0% isn't likely to change anytime soon either.