Dominant — or perhaps more accurately, all-conquering — social network Facebook is gearing up for its hugely anticipated IPO next month.

Our sister site fool.com runs an investing service — Motley Fool Rule Breakers — which is currently crushing the S&P 500. David Gardner, Motley Fool co-founder and Advisor on the service, has made an investing career out of finding companies that are breaking all the rules – and becoming wildly successful in the process.

With the company having not yet listed, (and the Rule Breakers team not having given a view), here's one Fool's thoughts on how well Facebook might match up against the team's initial screening criteria.

More Reading

- The most expensive stock I've ever seen

- 3 stocks that moved by more than 5 per cent on Tuesday

- 4 ASX stocks that jumped over 10 per cent last week

There are six signs of a Rule Breaker.

1. Top dog and first mover in an important, emerging industry

Facebook needs no introduction as the most popular social network today. While it's unquestionably the top dog in social networking, it technically wasn't the first mover, as Friendster's launch predated Facebook by a couple of years. Friendster launched a decade ago, and MySpace followed suit two years later.

Facebook launched around the same time in 2004 but was initially limited to college students. It wouldn't be until 2006 that Facebook would open its digital doors to the masses. It was among the first movers and is hands down the top dog in the increasingly important realm of social networking.

Check.

2. Sustainable advantage gained through business momentum, patent protection, visionary leadership, or inept competitors

MySpace was once largely viewed as Facebook's primary competitor, but it has mostly fallen by the wayside and is now geared toward a niche segment of the market. Just last year, News Corp sold the site to Specific Media, losing more than half a billion dollars in the six-year trade.

Nowadays, Google (Nasdaq: GOOG) is Facebook's biggest rival as Facebook encroaches into Big G's advertising market. Google's response is its own Google+ social network, although this has yet to gain meaningful traction and is far short of a Facebook killer.

Personally, I don't currently see Mark Zuckerberg as a visionary leader. I tend to view him as a lucky guy who was in the right place at the right time. Although, in fairness, Microsoft's (Nasdaq: MSFT) Bill Gates has said the same thing about himself, but Gates had a clear vision of the PC industry. Over time, Zuckerberg may prove that he has a vision for the open and social Internet, so I'll give him the benefit of the doubt.

Facebook's biggest advantage right now is its network effects, as it now boasts more than 900 million monthly active users, or MAUs — up from 197 million three years ago. That's 13% of the 7 billion global population and almost half of the 2 billion global Internet users that Facebook estimates (based on IDC figures) as its addressable user opportunity. Facebook definitely has business momentum.

Despite my qualms regarding Zuckerberg, I'm going to give Facebook this one due to its overwhelming momentum and lack of meaningful social networking competition, even from heavyweight Google.

Check.

3. Strong past price appreciation

Facebook's valuation has skyrocketed over the years. Just look at this chart that fellow Fools compiled in February.

That price appreciation looks pretty strong to me.

Check.

4. Good management and smart backing

I've already expressed my feelings on Zuckerberg, but he also has a strong management team and board behind him.

COO Sheryl Sandberg, a Harvard MBA, spent seven years at the U.S. Treasury Department, followed by more than six years as the VP of global online sales and operations at Google. She was named COO in 2008. CFO David Ebersman was CFO at now-private biotech Genentech for 15 years. Don't forget that Netflix's (Nasdaq: NFLX) Reed Hastings sits on Facebook's board and PayPal co-founder Peter Thiel is also a director.

Accel Partners was an early venture capital backer for Facebook as early as 2005 (and still owns more than 201 million class B shares), and it also helped fund successful startups like Dropbox, AdMob, Etsy, and Kayak, among many others.

Check.

5. Strong consumer appeal

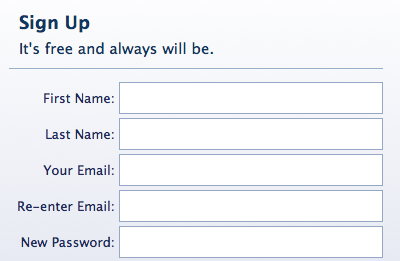

This one is easy. Simply put: How many people do you know who aren't on Facebook? The site is the de facto standard for social networking, with 901 million MAUs enjoying a free service to connect with people.

Source: Facebook.com.

Facebook has also made it clear that the service will always be free, so it's nearly impossible for Facebook to lose its consumer appeal. It would have to do something unimaginably egregious to put off enough users to invalidate its strong network effects.

Check.

6. You must find documented proof that it is overvalued according to the financial media

There are plenty of examples of the financial media, including Fool.com, calling Facebook overvalued.

- "Twitter, Facebook Grossly Overvalued" — Seeking Alpha, April 8, 2009

- "The Most Overvalued Company in Tech" — Fool.com, Dec. 20, 2010

- "Is Facebook Overvalued?" — The Week, Dec. 29, 2010

- "Facebook Overvalued at $50 Billion in Investor Poll" — Bloomberg, Jan. 28, 2011

- "Is Facebook Worth $100 Billion?" — The Wall Street Journal, July 14, 2011

- "Facebook's IPO Will Be Way Overvalued" — MarketWatch, Feb. 1, 2012

- "Facebook IPO: Tech Bubble 2.0?" — Kapitall (via Fool.com), Feb. 2, 2012

Facebook has reported trailing-12-month revenue of US$3.4 billion and net income of US$974 million. At the expected US$100 billion valuation, we're looking at a price-to-sales ratio of 29.4 and a price-to-earnings ratio of 102.7 — textbook cases of lofty multiples.

Check.

Final score: six of six

By my count, Facebook shows all six signs of a Rule Breaker, but this is but a starting point.

Professional social networker LinkedIn (NYSE: LNKD) has a very different monetisation model for its users. LinkedIn's P/E of nearly 900 makes even Facebook look like a value stock in comparison.

Now Facebook just needs to complete its IPO. It promises to be an interesting journey.

The ASX is already on the move in 2012, and Goldman Sachs experts recently said they reckon S&P/ASX 200 could top 5,000 next year. Read This Before The Coming Market Rally is a must-read for investors who don't want to miss out on the party. Click here now to request your free copy, before it's too late.

Take Stock is The Motley Fool Australia's free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Click here now to request your free subscription, whilst it's still available. This article contains general investment advice only (under AFSL 400691).

A version of this article, written by Evan Niu, originally appeared on fool.com