This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Nvidia (NASDAQ: NVDA) was one of the top stocks to own in 2025, marking the third straight year in which Nvidia outperformed the market. That's an impressive run, and I have no reason to doubt that Nvidia will continue that streak heading into 2026.

Even after its 38% rise in 2025, I think Nvidia is still a top buy for 2026. I've got a handful of reasons why Nvidia is still a top buy now, and investors who don't have enough exposure to the top growth stock in the market should consider them as a reason to buy more.

1. AI spending isn't slowing down

After three years of artificial intelligence spending increasing, 2026 appears to be another year of growth. All the AI hyperscalers have informed investors that they should expect higher capital expenditures in 2026 than in 2025. Several companies benefit from these higher spending amounts, and Nvidia is one of them.

For example, Meta Platforms told investors during its Q3 earnings announcement that its "capital expenditures dollar growth will be notably larger in 2026 than 2025." In 2024, Meta spent $39 billion on capital expenditures. For 2025, it expects full-year capital expenditures to be around $70 billion to $72 billion. If Meta continues this acceleration, it's reasonable to expect its AI spending to reach $100 billion by 2026.

While Meta isn't spending all of that money on Nvidia graphics processing units (GPUs), a decent chunk will be heading Nvidia's way. This same story can be repeated for practically any AI company, making Nvidia a strong candidate to own in 2026.

2. 2026 isn't going to be the last year of AI growth

This won't be the last year we see strong AI growth. Data centers take a considerable amount of time to build, and many of the plans announced in 2025 won't be fully operational for several years. This means that they won't be purchasing Nvidia chips for a few years, so the AI growth trend will stretch out beyond 2026. That's why Nvidia has informed investors that it expects global data center capital expenditures to rise from $600 billion in 2025 to $3 trillion to $4 trillion by 2030.

With multiple years of AI growth expected, Nvidia is a great stock to buy and hold.

3. Nvidia isn't as expensive as you may think

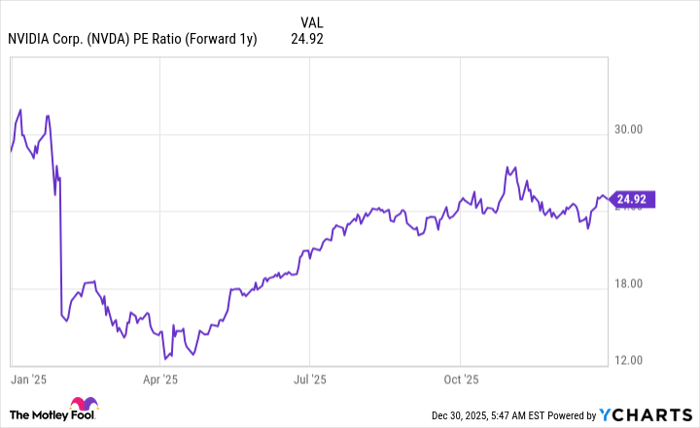

There is a common misconception in the market that Nvidia's stock is overvalued. However, when you factor in the growth Nvidia is expected to deliver, this argument breaks down quickly. Nvidia trades for about 25 times fiscal year 2027's (ending January 2027) earnings.

NVDA PE Ratio (Forward 1y) data by YCharts.

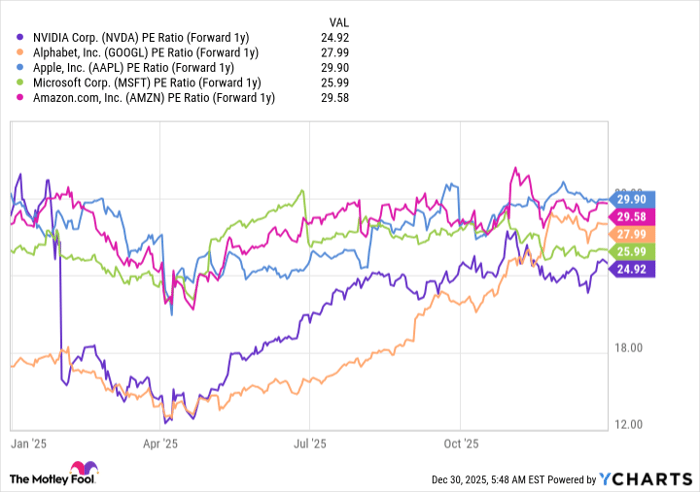

That's right in line with where other big tech companies trade, yet they don't have the great long-term prospects Nvidia does.

NVDA PE Ratio (Forward 1y) data by YCharts.

4. Nvidia doesn't have the capacity to meet demand

The massive AI demand for advanced chips has consumed all of Nvidia's production capacity. During its earnings call for the fiscal 2026 third quarter, Nvidia informed investors that it is "sold out" of cloud GPUs. When demand outpaces supply, that allows Nvidia to maintain its high margins and also control the supply of chips. Although alternatives are starting to emerge as real competition for Nvidia, it's still at the top of the AI food chain.

Nvidia is working as hard as it can to increase capacity to meet demand for its products, but just because you hear about an AI hyperscaler creating its own chips doesn't mean it's completely shifting away from Nvidia's technology.

Nvidia is still the top name in AI computing, and with AI spending expected to continue rising over the next few years, Nvidia is an excellent stock to buy hand over fist.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.